See below for the April 2016 edition of our E-newsletter, The Advisor

See below for the April 2016 edition of our E-newsletter, The Advisor

Target Date Funds Held Within Participants’ Retirement Savings

How are custom solutions evolving to mitigate risk?

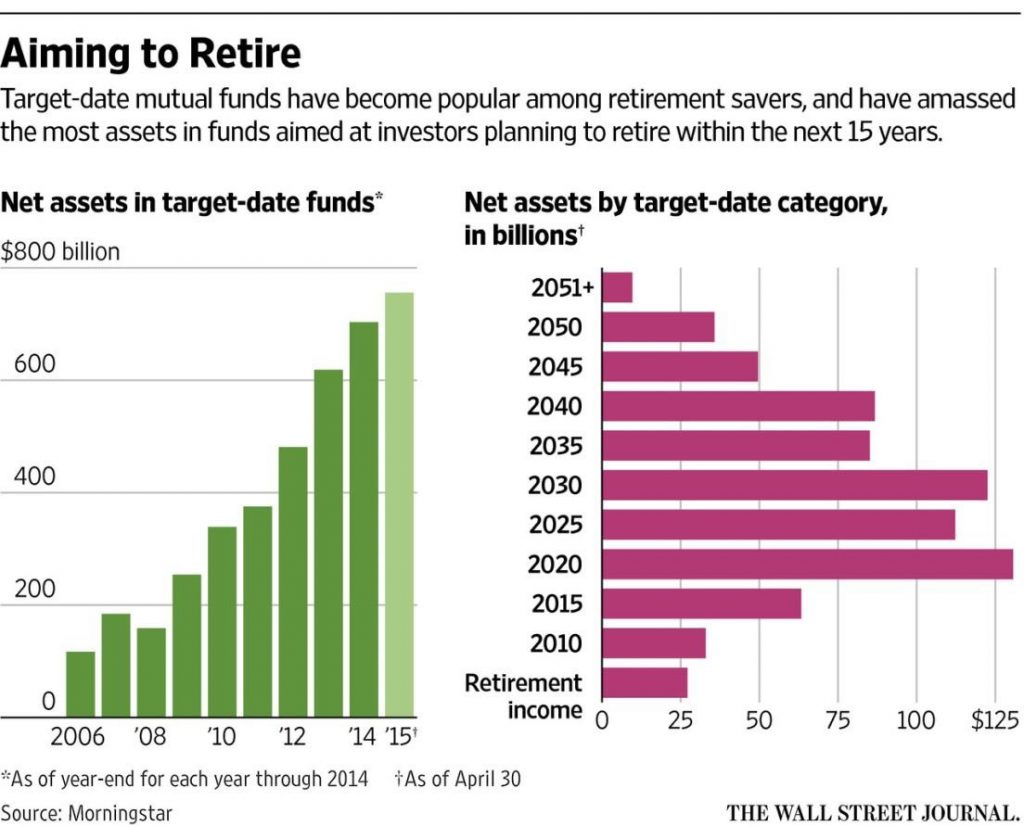

Since the Pension Protection Act of 2006, target date funds (TDFs) have increasingly found their way into retirement plans as the preferred qualified default investment alternative (QDIA) for participants who make no election. Not only have plan sponsors widely adopted TDFs as the plan’s QDIA, but participants have also gravitated to this type of fund option because of its ease of use as a “one-stop shop,” allowing the selection of one fund option based on expected retirement date. A TDF diversifies and grows more conservative over time as the participant approaches the named retirement date in the fund. At present, TDFs can be found in the majority of retirement plans and are expected to increasingly become the primary if not only vehicle for most retirement plan participants.

The simplicity of TDFs for plan sponsors and participants has been of paramount importance and a key driver for success on all levels, including adoption, utilization and regulatory compliance. But are TDFs really a “silver bullet” for plan sponsors and participants? Has the attempt to lessen certain risks in saving for retirement instead introduced new risks?

Version 1.0: Inception of TDFs

BlackRock created the first TDF in 1993. Every aspect of a TDF, from the glidepath (asset allocation) to the underlying investments, was managed by BlackRock. This single-manager, single-glidepath model is version 1.0 of the TDF. This model has seen the most growth over the past 20 plus years, as managers like BlackRock and others have built proprietary TDFs to support this fast-growing industry. Version 1.0 continues to remain the most common TDF in defined contribution plans today. One reason is the simplicity of version 1.0 TDFs. The entire investment solution is in one place, efficiently packaged. Another reason is because early on in the development of TDFs, recordkeepers typically only offered one proprietary TDF, usually their own, on their recordkeeping systems. This limited plan sponsors and participants to one glidepath and one investment manager. As the TDF industry has matured, fiduciaries and the DOL have increasingly become more concerned about the version 1.0 design because of its inherent and sometimes unseen, or misunderstood, risk to the plan sponsor and participants.

As version 1.0 providers have multiplied, the number of glidepaths has increased as well. Interestingly, there is a stark difference among glidepath providers when it comes to asset allocation; for example, an allocation to equity at retirement varies as much as 50 percent. Because there is a lack of uniformity among TDF providers, participants in one TDF series are likely on a very different glidepath to retirement, or have a very different asset allocation, than participants in another TDF series.

For example, T. Rowe Price, a large equity manager, has one of the more aggressive glidepaths of version 1.0 TDF providers, with approximately 55 percent equity exposure at retirement. PIMCO, on the other hand, a large bond manager, has approximately 20 percent equity exposure at retirement (with a large percentage in bonds). Certainly, investment management skill and expertise in their business segments likely drive the allocation.

These large differences in equity exposure create significant variance in participants’ retirement outcomes because equity risk is the primary driver of glidepath risk. To date, the message around TDFs has been that they grow more conservative over time. In this simplicity, the degree and magnitude of this shift to more conservative assets has been overlooked. Participants on different glidepaths face different risks; the biggest risk is driven by asset allocation to risk-based assets like stocks versus more conservative assets like bonds and cash.

TDF providers under version 1.0 not only determine the single glidepath or asset allocation, they also select and populate the TDF series with their own investment product. While the glidepath may be the biggest driver of retirement outcomes, it is the investment product within the TDF that typically dictates the fees paid to the provider.

As more and more attention has turned to the underlying investment strategies within a TDF, more evidence suggests that plan sponsors make accommodations for underperforming investment strategies. Clearly, better fiduciary governance can be applied at the TDF level. Unfortunately, even if applied, version 1.0 allows no flexibility to fiduciaries to ensure that there are glidepath options for the individual or that underperforming managers can be replaced. More flexibility is needed if plan sponsors are to treat TDFs the same as they do other investments offered within the plan.

This is an excerpt of flexPATH Strategies’ white paper, Oversimplification in Target Date Funds Endangers Participants’ Retirement Savings – How are custom solutions evolving to mitigate risk? Next month we will release Part II of the white paper and introduce version 2.0 which sets the stage for version 3.0. To view the white paper in its entirety, please click here.

Shedding Light on Collective Investment Trust Funds

Early collective investment trusts (CITs) were pools of securities, traded manually, and typically valued only once a quarter. While popular in defined benefit plans, CITs were not as widely accepted in defined contribution plans due to operational constraints and a lack of information available to plan participants.

Today, there is growing concern over how 401(k) plans are structured and the costs involved. Due to operational improvements, competitive fees, and accessible information, we are seeing a resurgence in the popularity of CITs.

Here we look at some of the myths these investment products still carry and shed some light on their benefits and how they should be used.

What is a Collective Investment Trust Fund (CIT)?

A CIT is a commingled (i.e., pooled) investment vehicle designed exclusively for use in qualified employee benefit plans that is administered by a bank or trust company and is regulated in the same manner as the administering bank or trust company. CITs are not guaranteed by the bank or FDIC and are subject to the same risks as any investment. CITs are also subject to oversight from the Internal Revenue Service (IRS) (Revenue Rating 81-100) and Department of Labor, and are held to ERISA fiduciary standards with respect to plan assets. As bank-maintained funds, CITs are exempt from registration with the Securities and Exchange Commission (SEC) under the Investment Company Act of 1940.

Myth vs. Reality

| MYTH | CITs are a relatively new investment option that is not widely available | CITs lack the reporting and transparency necessary to fulfill ongoing due diligence requirements | CITs are not regulated and are risky investments | CITs provide fees comparable to mutual funds without any added value |

| REALITY | CITs have long been popular in defined benefit plans, and are increasingly a choice in defined contribution plans | CIT managers have worked diligently with Morningstar and other databases to report fund level data on a regular basis | CITs have bank regulatory requirements, as well as additional oversight from the IRS and Department of Labor | CIT fees tend to be more cost effective and may offer flexible pricing |

The Advantages of CITs

Designed to streamline management and mitigate risk

• Similar structure as mutual funds and other pooled vehicles – assets of investors with similar objectives are commingled in a single portfolio

• Portfolio is professionally invested by a third party based on the select objective

• Broad array of strategies available to meet demand

• Only for retirement plan investors so all share a long-term investment perspective

Trustees may provide additional fiduciary protection within the meaning of sections 3(21) and/or 3(38) of ERISA

• CIT trustees and sub-advisors serve as ERISA fiduciaries with respect to the assets invested in CITs

• Must comply with ERISA fiduciary standards to avoid conflict of interest

• Act solely in best interest of plan participants and beneficiaries

Cost advantages and greater pricing flexibility relative to mutual funds

• Can be quicker and less expensive to create as costly registration fees and public disclosure requirements are eliminated

• Often have lower administrative, marketing, and distribution costs than mutual funds

• Savings offered by CITs can be passed on to plan sponsors and participants

• Fees may be negotiable, especially for large institutions

Risks Associated With CITs

• Plan participant assets cannot be rolled if the participant changes employers

• CITs typically have shorter performance track records and the performance track record may be difficult to verify due to lack of SEC regulation.

For more information on CITs, please contact your plan consultant at Everhart Advisors via e-mail at info@everhartadvisors.com or phone at 800-337-3353.

This article was originally published by Manning & Napier. https://www.manning-napier.com/Corporate/Insights/OurView/Article/tabid/310/Article/356/Shedding-Some-Light-on-CITs.aspx

3(16) ERISA Fiduciary Definition

Recently there has been an emergence of entities offering to provide ERISA Section 3(16) services. Plan sponsors may be interested in divesting themselves of Section 3(16) plan administrator responsibilities and there are questions regarding this concept and its perceived desirability. The unfortunate reality is that the advertisements, marketing material and articles (often written by interested parties who sell these services) are often quite misleading and contain a substantial disconnect between the scope of services required versus those actually covered.

ERISA Section 3(16) states the definition for “plan administrator” as responsible for the daily operation of the plan. A plan administrator under ERISA 3(16) is identified in the plan document and if the plan document is not specific, the plan sponsor is considered to be the 3(16) fiduciary.

ERISA 3(16) fiduciary responsibilities include, but are not limited to:

– Interpretation of the plan document, required reporting and disclosures (i.e. Form 5500), selection, evaluation and monitoring of: other plan fiduciaries, service providers, plan investments, any investment advisor to the plan and reasonableness of all plan fees and contracts.

– Distribution of SPD/SMM, participant fee disclosure, benefit statements, QDIA notices and other required participant disclosures, distribution of benefits, administration of QDROs (procedures and process) and administration of loans.

Approach organizations offering 3(16) services with caution as the strength of the purported offloading of fiduciary responsibility is untested to date. In addition, plan sponsors should review any such offerings in extreme detail as few, if any, organizations truly accept a full 3(16) scope. Most organizations agree to serve in a 3(16) capacity limited to the service being provided (loan processing, hardship approval, etc.). It is highly unlikely that a plan sponsor can hope to avoid or transfer fiduciary responsibility merely by engaging an organization as a 3(16) plan administrator because even that selection (unless included in the plan document) carries fiduciary implications, and thus ongoing monitoring of the selected 3(16) is required. Therefore the plan sponsor retains potential fiduciary responsibilities and thus liability exposure. Finally, when considering engaging a 3(16) advisor keep in mind: (1) few, if any, advisors have the experience, let alone the proper infrastructure, to take on the administration of the plan – this is best left to third party administrators and recordkeepers; and (2) no advisor will be capable of possessing all the knowledge, data and authority necessary to act in a full scope 3(16) capacity – this is due to the fact that human resources, payroll, etc. are still not managed by the advisor.

It is important to remember that the same procedurally prudent process that accompanies any ERISA fiduciary decision certainly should apply when considering an external ERISA 3(16) Fiduciary as well.

ERISA Section 3(16) states the definition for “plan administrator,” as the person responsible for the daily operation of the plan.

Interpretation of the plan document, required reporting and disclosures (i.e. Form 5500), selection, evaluation and monitoring of: other plan fiduciaries, service providers, plan investments, any investment advisor to the plan and determining reasonableness of all plan fees and contracts.

Understanding Multiemployer Plans

The Labor Management Relations Act of 1947 (also known as the Taft Hartley Act) allowed for the establishment of multiemployer benefit plans, often referred to as “Taft-Hartley plans”. A multiemployer plan, not to be confused with a Multiple Employer Plan (MEP), is a collectively bargained plan maintained by more than one employer, usually within the same or related industries, and a labor union. The plan and its assets are managed by a joint board of trustees equally representative of management and labor. The plan trustees are the decision makers who have the fiduciary responsibility to operate the plan in a prudent manner.

Multiemployer plans may vary in size from very few employers to hundreds of employers. The employers agree in the collective bargaining agreement(s) with the union to contribute on behalf of covered employees who are performing covered employment. Contributions may be based on the number of hours worked, the number of shifts worked, or another base negotiated during the collective bargaining process (e.g., employers may be required to pay $2.00 for each hour of covered employment performed by a covered employee). Contributions are placed in a trust fund, legally distinct from the union and the employers, for the sole and exclusive benefit of the employees and their families.

Multiemployer plans are designed for workers in industries where it is common to move from employer to employer. Under this structure, participants are allowed to gain credits toward pension benefits from work with multiple employers as long as each employer has entered into a collective bargaining agreement requiring contributions to the plan. For example, service sufficient to meet vesting requirements may be obtained by working for one or many employers. Similarly, service required to be eligible to retire is dependent on service under the plan, not service with any particular employer. Accordingly, employees are able to change employers, without losing eligibility or service toward vesting, provided the new job is with an employer who participates in the same multiemployer plan. For more information on this subject, please contact Everhart Advisors via phone at 800-337-3353 or e-mail at info@everhartadvisors.com.

[separator top=”40″]

Communication Corner: Retirement Planning

This month’s employee memo shows participants how much they can save between a 10 and 30 year time period and how they may possibly increase their retirement savings by increasing their contributions by just a small percentage.

Email Marketing Software

powered by Cvent

The “Retirement Times” is published monthly by Retirement Plan Advisory Group’s marketing team. This material is intended for informational purposes only and should not be construed as legal advice and is not intended to replace the advice of a qualified attorney, tax adviser, investment professional or insurance agent. (c) 2016. Retirement Plan Advisory Group.

Mutual funds are sold by prospectus only. Before investing, investors should carefully consider the investment objectives, risks, charges and expenses of a mutual fund. The fund prospectus provides this and other important information. Please contact your representative or the Company to obtain a prospectus. Please read the prospectus carefully before investing or sending money. Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions. . Rebalancing assets can have tax consequences. If you sell assets in a taxable account you may have to pay tax on any gain resulting from the sale. Please consult your tax advisor. S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. You cannot directly invest in the index.

Securities are offered through Mid Atlantic Capital Corporation (MACC), a registered Broker Dealer, Member FINRA/SIPC. Financial Advice is offered through Everhart Advisors a Registered Investment Adviser. Everhart Advisors is not a subsidiary or control affiliate of MACC. ACR#180988 04/16