Everhart Advisors has a strategic partnership with the Club Management Association of America (CMAA) and provides guidance on the National Club 401(k) Retirement Plan, accessible to all CMAA member clubs. This plan offers clubs a cost-effective and tailored retirement solution designed to meet their specific needs and those of their employees. Additionally, Everhart Advisors serves as a faculty member for the Business Management Institute, offering education to individuals working towards the Certified Club Manager designation.

Relationships Matter

CMAA has partnered with industry experts to provide a 401(k) retirement benefit plan for member managed clubs. This outsourcing opportunity to reduce both the fiduciary and administrative burdens of sponsoring a retirement plan has well established relationships, working together to provide compliance, education, and individual investment education. The CMAA provides both an ERISA 3(38) Investment Manager and 3(16) Administrator as named fiduciary relationships to the plan.

Plan Sponsor

ERISA 3(38) Investment Manager & Named Fiduciary to the Plan

Recordkeeper/ Custodian

ERISA 3(16) Administrator/ Compliance & Named Fiduciary to the Plan

Why consider being part of your association’s National 401(k) Retirement Plan Benefit?

- Potential Cost Savings

- Removal of Annual Audit Requirement

- Flexible Plan Design (Club Culture Retention)

- ERISA 3(38) Investment Management

- ERISA 3(16) Administration

- Outsourcing of Notice Requirements

- Secure Act 2.0 Readiness

- CEFEX Certified Advisors

- Onsite, Remote and Video Education

- Creation of an Investment Policy Statement (IPS)

- Mutual Funds and Collective Investment Trust (CIT) Investment Options

- Outsourcing and Mitigation of Most Fiduciary Responsibilities

- No ERISA Bond Requirement

Executive Benefit Consultations

- Deferred Compensation: 457(b), 457(f), 409A

- Life Insurance and Club Owned Annuity Programs

- Investment and Financial Advice

- Personal Financial Mission Statement

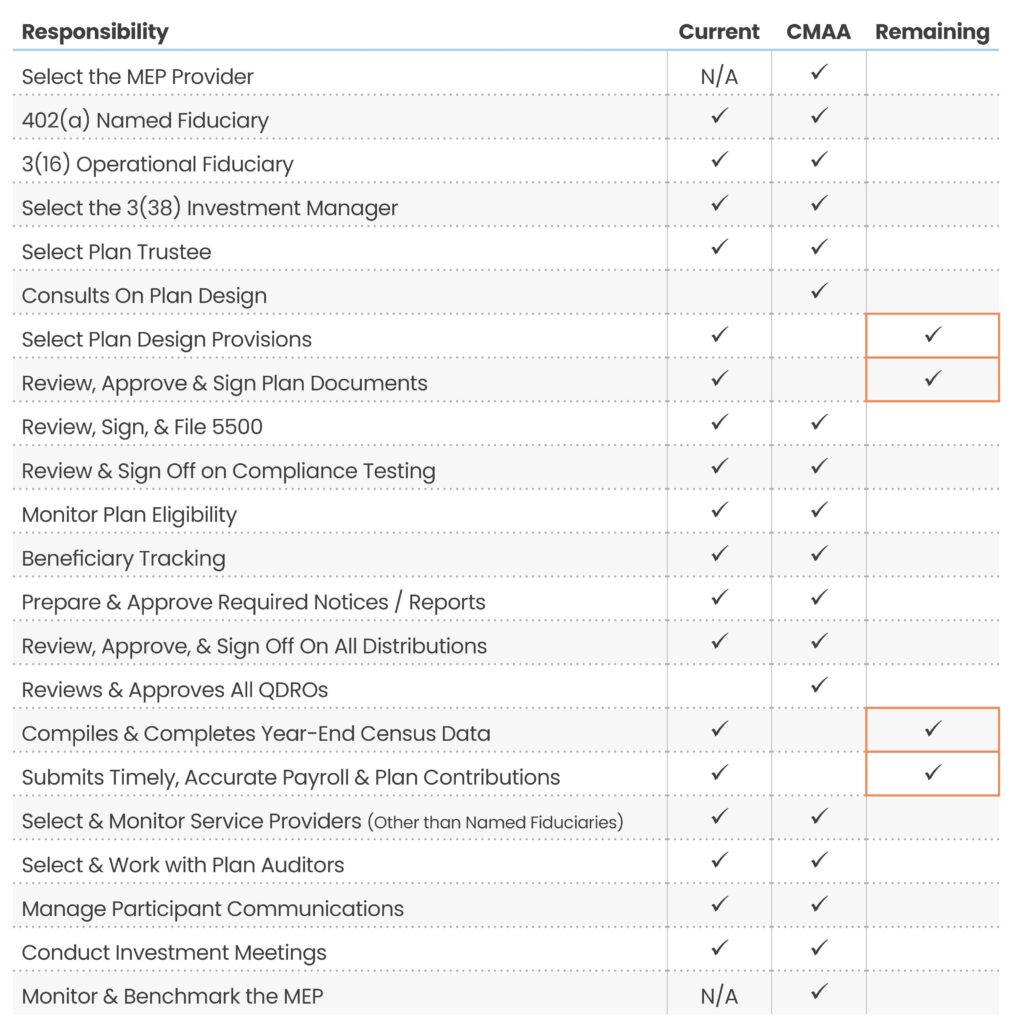

CMAA National Plan (MEP) vs. Club Plan Responsibilities

Common Roles When Sponsoring a Retirement Plan Benefit

In an ever changing legal and legislative landscape, reducing the ongoing administrative tasks required of most standalone retirement plans allow clubs to focus their attention and resources on enhancing their club member experience. The chart above provides an example of the responsibilities that clubs must fulfill when offering a retirement benefit to their staff. Adoption of the National Plan has the potential to enhance services, save on expenses and provide greater financial education engagement, while reducing the administrative resources required to sponsor an individual plan benefit.

National Club 401(k) Plan Committee

The committee meets as a monitoring fiduciary body to review, modify, and maintain the program investment options and compliance related functions.

Jeff Morgan

FASAE, CAE

Jason Tate

CPA

Tony D’Errico

CCM, CCE

Damon DiOrio

CCM, CCE

Michael Seabrook

CCM, CCE

This information was developed as a general guide to educate plan sponsors but is not intended as authoritative guidance or tax or legal advice. Each plan has unique requirements, and you should consult your attorney or tax adviser for guidance on your specific situation. In no way does adviser assure that, by using the information provided, plan sponsors will be in compliance with ERISA regulations. Any performance numbers either written or spoken as part of this presentation are based on historical data and do not guarantee any future performance. Images on the title page represent participants in the National Plan.

Energize Your 401(k) Benefit

For inquiries about benchmarking and proposals, please reach out to us.