See below for the August 2016 edition of our E-newsletter, The Advisor

See below for the August 2016 edition of our E-newsletter, The Advisor

“Conflict of Interest” or “Fiduciary” Rule: A Plan Sponsor’s Q&A – Part I

After years of proposed regulation issuance, comment periods, drafting and anticipation, the Department of Labor (DOL) finally published final guidance regarding the definition of “fiduciary” on April 8, 2016. It is important for plan sponsors to understand the reasoning behind, and the scope, of the final rules. The following Q&A is meant to assist you in understanding the regulations and how they pertain to you, your plan and your participants.

Q: Why did the DOL issue these new rules?

A: The definition of “fiduciary” for purposes of providing investment advice dates back decades, predating the advent of 401(k) and other defined contribution plans. Prevalent thought within the retirement industry was that the definition was due for an update to reflect the evolution of the retirement plan landscape and to bring more parties under the scope of ERISA’s standard of care for fiduciaries.

Q: Who are the primary targets of the new rules?

A: The primary targets of the new rules are providers of retirement plan services and products. Advisors, consultants, recordkeepers, third party administrators, etc., are those most impacted by the new rules. The primary objective of the regulations is to sweep into the definition of “fiduciary” more individuals and organizations who may influence plans, plan sponsor fiduciaries and participants in regards to investing-related activities. In so doing, these individuals/organizations will be held to the highest standard of care in providing investment advice and recommendations under the terms of ERISA.

Q: In a nutshell, what do the new rules say?

A: Essentially the new rules provide that an individual/organization will be a fiduciary under ERISA if they make a recommendation to a plan, plan sponsor fiduciary (e.g., a plan committee) or plan participant (or beneficiary) regarding investment products/services, distributions or rollovers . . . and they receive a fee for doing so. “Recommendation” is defined as a communication that can reasonably be viewed as a suggestion that the recipient of the information take (or refrain from taking) some course of action.

Q: In the past I recall hearing that certain providers could not be a fiduciary, does that remain true?

A: In the past, service providers that received uneven, or “conflicted” compensation, would not agree to serve in a fiduciary capacity because they could affect, or influence, their compensation which would have resulted in a prohibited transaction.

Under the new rules, a Best Interest Contract Exemption (the “BIC Exemption”) has been created to account for such scenarios. Additionally under the new rules, all individuals/organizations meeting the definition of fiduciary are going to be treated as fiduciaries, regardless of the design of their compensation. In order to avoid a prohibited transaction, fiduciaries receiving conflicted compensation (such as commissions) can continue such compensation design as long as they meet certain requirements, one of which is to commit to providing recommendations that are in the best interests of the recipient of services/recommendations.

Q: Does our plan fall under the new rules?

A: All ERISA-covered plans that have an investment element will be covered. 401(k), 403(b), profit sharing, money purchase pension and defined benefit plans will all be covered. Interestingly, recommendations for taking a distribution or rolling over to an IRA will also be covered. And an unexpected surprise for most plan sponsors is that health savings accounts (HSAs) are also covered.

Be sure to read next month’s edition of The Advisor where we will feature another five Q&As on the “Conflict of Interest” or “Fiduciary” Rule.

Participant Behaviors

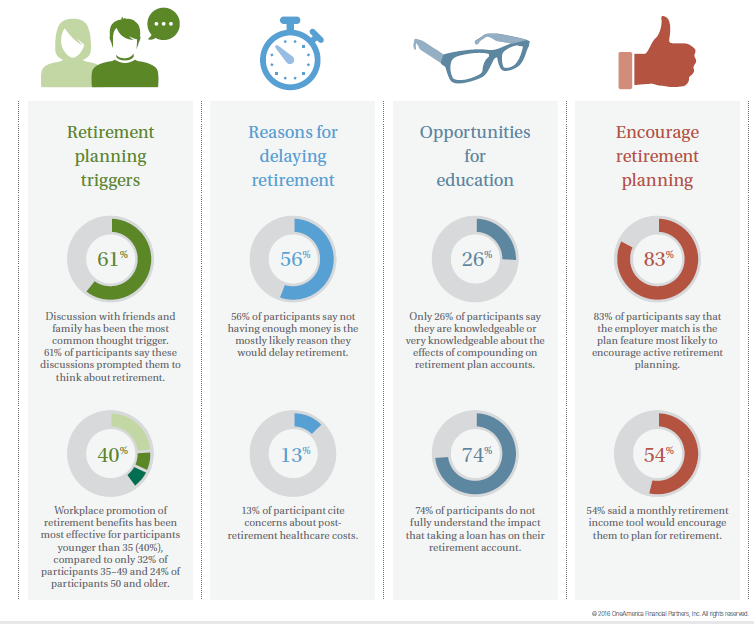

From August 27, 2015-January 31, 2016, OneAmerica® fielded an online survey to visitors to its participant website to better understand retirement planning and personal finance behaviors and what resources might be most effective in helping plan participants prepare for retirement. A total of 10,829 participants answered questions about their planning triggers and motivations, education and resource preferences and what roadblocks to retirement they may encounter. The survey results give us insights into how plan sponsors can work with participants to improve their financial wellness and overcome retirement planning hurdles.

This article was contributed by OneAmerica.

Organizing Your Fiduciary File

As a plan sponsor and fiduciary of your company’s retirement plan, keeping an up-to-date fiduciary file is critical.

To begin, we recommend preparing your file in four key sections; contents of each section could

include the following:

I. Documents: plan document, IRS determination letter, summary plan description, investment policy

statement, 404(c) policy statement and notice, form 5500s; service provider contracts; nondiscrimination

test results, corporate tax returns, corporate board resolutions, etc.

II. Administrative: evidence of employer contributions, distribution documents; audit results; participant

complaints; fiduciary liability insurance contract, correspondence, etc.

III. Participant Communication: enrollment material, documentation of communication events, etc.

IV. Investments: documentation of investment activity, executive summaries from committee meetings,

current fund menu and expenses, etc.

We are prepared to support you throughout your compliance process. For more information please contact Everhart Advisors at 800.337.3353 or via e-mail at info@everhartadvisors.com.

Allowable Plan Expenses: Can the Plan Pay?

The payment of expenses by an ERISA plan (401(k), defined benefit plan, money purchase plan, etc.) out of plan assets is subject to ERISA’s fiduciary rules. The “exclusive benefit rule” requires a plan’s assets be used exclusively for providing benefits. ERISA also imposes upon fiduciaries the duty to defray reasonable expenses of plan administration. General principles of allowable expenses include the following:

• The expenses must be necessary for the administration of the plan.

• The plan’s document and trust agreement must permit use of plan assets for payment of expenses.

• The expenses must be reasonable and incurred primarily for the benefit of participants/beneficiaries.

• The expense cannot be the result of a transaction that is a prohibited transaction under ERISA, or it must qualify under an exemption from the prohibited transaction rules.

In light of today’s plan fee environment, it is incumbent upon fiduciaries to request full disclosure of fees and expenses, how they breakdown with services provided, as well as a request for full explanation of who will be the recipient of fees. Ultimately the ability to pay expenses from a plan trust is a facts and circumstances determination that needs to be made by plan fiduciaries. Because it is possible that the DOL may challenge such determinations it is important that fiduciaries consult ERISA counsel prior to paying questionable expenses from a plan trust and document the decision and reasoning. For more information please contact Everhart Advisors at 800.337.3353 or via e-mail at info@everhartadvisors.com.

[separator top=”40″]

Communication Corner: Invest in Your Child

This month’s memo talks about the benefits of starting a 529 College Savings Plan.

Email Marketing Software

powered by Cvent

The “Retirement Times” is published monthly by Retirement Plan Advisory Group’s marketing team. This material is intended for informational purposes only and should not be construed as legal advice and is not intended to replace the advice of a qualified attorney, tax adviser, investment professional or insurance agent. (c) 2016. Retirement Plan Advisory Group.

Securities are offered through Mid Atlantic Capital Corporation (MACC), a registered Broker Dealer, Member FINRA/SIPC. Financial Advice is offered through Everhart Advisors a Registered Investment Adviser. Everhart Advisors is not a subsidiary or control affiliate of MACC.

ACR#202585 08/16