See below for the June 2016 edition of our E-newsletter, The Advisor

See below for the June 2016 edition of our E-newsletter, The Advisor

Oversimplification in Target Date Funds Endangers Participants’ Retirement Savings

How are custom solutions evolving to mitigate risk? Part III

Last month we featured Part II of Oversimplification in Target Date Funds Endangers Participants’ Retirement Savings – How are custom solutions evolving to mitigate risk? Part II introduced version 2.0 of target date funds (TDFs), an approach which allows plan sponsors to develop a glidepath best suited for their plan’s demographics. For the final installment of our three-part series, learn about version 3.0 of TDFs.

Addressing Participants’ Different Needs and Goals

Clear evidence appears when looking at research and studies that show participants vary in their savings patterns, specifically in how much they defer from income today. This is key to estimating a minimum level of retirement savings needed to live on in retirement. Those who would like to live more extravagantly simply need to save more than this minimum amount. A recent Vanguard study² examined the deferral rates for all participants on their recordkeeping platform and found the following based on the median participant deferral rate of 6 percent:

• Participants deferring less than 6 percent: 53 percent

• Participants deferring 6–10 percent: 25 percent

• Participants deferring more than 10 percent: 22 percent

A participant’s savings rate is one of the largest factors to determine his or her total savings at retirement. Clearly, the assumptions to which version 1.0 providers and even version 2.0 plan sponsors have built their glidepaths do not accommodate the wide array of savings rates found within most plans. Therefore, this is the ultimate risk of TDF oversimplicity: only one assumed deferral rate. Many version 1.0 providers use what Vanguard identified as the median deferral rate, 6 percent. While plan sponsors may tweak this number to fit their demographics, this deferral rate typically does not change much because it is an average of a large population. The range of distribution is often misrepresented, which then exposes participants to the risk that they are not saving the assumed rate of deferral driving the investment solution.

Misfit Risk Is the Greatest Risk to Plan Participants

The simple, single-glidepath model that assumes participants all save at the same rate presents risks to participants’ retirement savings. The single glidepath creates a misfit between what an individual participant is doing and how the glidepath is managed for the plan’s entire participant population.

Version 3.0 addresses this misfit risk by giving participants multiple risk-based glidepaths from which they can select: aggressive, moderate and conservative. In this approach, the simplicity of choosing a retirement date is replaced by choosing a retirement date and an appropriate risk-based glidepath. For example, for the retirement date of 2035, there would be three glidepaths from which a participant can select: an Aggressive 2035 fund, a Moderate 2035 fund and a Conservative 2035 fund. The principal value of a target date fund is not guaranteed at any time, including at the target date.

Version 3.0 helps address the cost issue through an old but commonly found fund structure within retirement plans: the CIT structure.

CITs allow the custom TDF to look and feel like mutual funds, which have been the predominant investment vehicle for retirement plans. CITs carry a performance track record, have their own fact sheets, and are portable across recordkeeping systems. Therefore, the CIT structure of version 3.0 combines the benefits of versions 1.0 and 2.0, while eliminating the misfit risk that participants accept by either selecting a TDF strategy based only on a retirement date or by being defaulted into the plan sponsor’s chosen single glidepath that represents some median or average participant but not the individual’s specific savings rate. At a minimum, version 3.0 presents participants with different allocation strategies, some carrying more risk than others. With education happening at the fund level in version 3.0, participants better understand that there is more to investing for retirement than just selecting a target retirement date.

Version 3.0 Removes the Risks of Oversimplification

The original and elegant idea of the TDF remains intact with version 3.0. The custom version 3.0 solution, with all its complexity, is actually not a difficult solution for the plan sponsor to implement and participants to understand. The most complex decision participants must make is selecting the date they expect to retire and the level of risk that is appropriate for their circumstances, solving for misfit risk. As TDF assets grow, expected to hit $1 trillion this year, misfit risk will only increase until more custom solutions like version 3.0 are adopted by plan sponsors and participants may have more choice because of it.

This material is from flexPATH Strategies’ white paper, Oversimplification in Target Date Funds Endangers Participants’ Retirement Savings – How are custom solutions evolving to mitigate risk? To view the white paper in its entirety, please click here.

Reversing Inertia

How re-enrollment boosts positive investment behaviors and participant outcomes — automatically.

The advent of automatic features in DC plans has had a positive impact driving retirement readiness by boosting participation and savings rates, especially among workers newer to the job. 73 percent of large and mega plans use auto-features, such as auto-enrollment and/or auto-escalation, to encourage greater savings in the DC plan.1

Through automatically enrolling new hires to the plan, and directing them to the qualified default investment alternative (QDIA) option, preferably with at least a 6 percent deferral rate to start, employees are not only able to save for retirement but can also do so within an appropriately allocated investment vehicle that matches their specific retirement needs or time horizon.

While most auto-default to the QDIA — whether an off-the-shelf or custom target date fund (TDF), balanced fund or managed account — employees who prefer to allocate and manage their own investments are able to choose from a selection of investment offerings from the plan’s core menu, or opt out of the plan altogether. For plans that implement auto-features, less than one-third of participants opt out, making it a powerful lever for the plan sponsor to effect change in the plan — and for participant outcomes.2

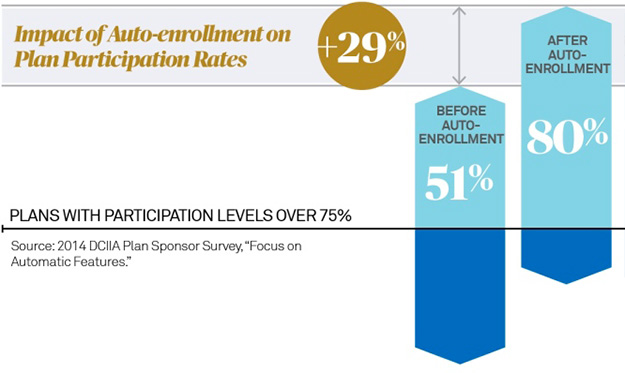

According to the 2014 DCIIA Plan Sponsor Survey3 of 471 plan sponsors across various DC plan types, industries and plan sizes (ranging from mega to small plans) auto-enrollment’s impact on participation is significant.

Separately, in the same study, plans that offer both auto-enrollment and auto-escalation have over twice as many participants with retirement savings rates over 15 percent as plans that do not offer both (14% vs. 6%, respectively).4

The combination of auto-features and other savings incentives (e.g., a matching contribution) chosen by the plan sponsor creates a “choice architecture” for employees’ retirement savings decisions, with increasing behavioral economics literature documenting that these plan design choices can have large effects on savings behavior.5 This in turn leads to an increase in a participant’s probability of success in reaching their optimal income replacement levels in retirement.

While this is promising, it’s becoming clear that two employee segments have been left out of the impact of auto-features, affecting their chance for retirement savings success:

![]() • Active plan participants hired before auto-enrollment and increased auto-deferral rates, resulting in a potentially misallocated investment strategy that may not meet their future needs, a low plan account balance and/or no ongoing contributions.

• Active plan participants hired before auto-enrollment and increased auto-deferral rates, resulting in a potentially misallocated investment strategy that may not meet their future needs, a low plan account balance and/or no ongoing contributions.

• Non-participating eligible employees hired prior to auto-enrollment, who chose not to participate in the plan, and are missing out on an impactful retirement savings tool (and potential match) altogether.

A positive nudge from plan sponsors via a plan re-enrollment could make all the difference.

1,2 The Cerulli Report, Retirement Markets 2014, “Sizing Opportunities in Private and Public Retirement Plans.”

3,4 2014 DCIIA Plan Sponsor Survey, “Focus on Automatic Plan Features.”

5 Source: Jeffrey R. Brown et al., Individual Account Investment Options and Portfolio Choice: Behavioral Lessons from 401(K) Plans 7 (Nat’l Bureau of Econ. Research, Working Paper No. 13169, 2007) per NYU School of Law, “A Behavioral Contract Theory Perspective on Retirement Savings,” Ryan Bubb, Patrick Corrigan and Patrick L. Warren, July 2015

This is an excerpt of BNY Mellon’s article in Planet DC Magazine, “Reversing Inertia.”

ERISA Fidelity Bond versus Fiduciary Liability Insurance

Plan sponsors often ask, “Is an ERISA fidelity bond the same thing as fiduciary liability insurance?” The answer is no, they are not the same. The two insure different people and have different requirements under the terms of ERISA.

An ERISA fidelity bond is required under ERISA Section 412. Its purpose is to protect the plan, and therefore the participants. It does this by ensuring that every fiduciary of an employee benefit plan, and every person who handles funds or other property of the plan, be bonded. This protects the plan from risk of loss due to fraud or dishonesty on the part of the bonded individuals. The amount of the fidelity bond is 10 percent of the plan assets (with a $1,000 minimum) and is capped at $500,000 (or $1,000,000 for plans with company stock).

Fiduciary liability insurance protects the fiduciaries (not the plan or participants) from a breach of their fiduciary responsibilities with respect to the plan. Remember that fiduciaries may be held personally liable for losses incurred by a plan as a result of their fiduciary failures. Unlike a fidelity bond, fiduciary liability insurance is not required under ERISA. The Department of Labor may ask whether the plan fiduciaries have insurance in the event of an investigation. It’s important that fiduciary liability insurance explicitly covers “ERISA” claims. Review of any policy, including E&O policies, should look for language that may void the coverage in the event a plan has ever been out of compliance (something virtually all plans experience at some point in their existence).

I’m Too Young to Save for Retirement!

Too often, we hear the younger generation of workers tell us saving for retirement is not high on their priority list. It’s easy to understand why retirement may not be a main priority. Instead of thinking about the long-term financial impact of ending their careers, most young workers today are focused on launching their careers. However, what the younger generation needs to understand is that this may be the most crucial time to begin saving for retirement. The earlier, the better!

Those individuals who start saving in a retirement plan early have the advantage of time and the power of compounding interest. The interest they’ve earned compounds over time, meaning they are letting their money work for them. The earlier that participants start saving, the more time their money has to compound and in result can grow quicker. Consider the following: If a participant begins saving for retirement at age 25, contributing just $2,000 for 40 years, they can achieve an ending balance of around $560,000 assuming an 8 percent annual rate of return. Let’s say they wait until they are 35 to begin saving for retirement, saving the same $2,000 every year, but for 30 years instead and assuming the same 8 percent annual rate of return. At age 65, they would end up with about $245,000 which is less than half the money if they would have started saving sooner!

The concept of retirement may be far off for the younger generation, but there may be no better time to begin saving for retirement than now.

Email Marketing Software

powered by Cvent

The “Retirement Times” is published monthly by Retirement Plan Advisory Group’s marketing team. This material is intended for informational purposes only and should not be construed as legal advice and is not intended to replace the advice of a qualified attorney, tax adviser, investment professional or insurance agent. (c) 2016. Retirement Plan Advisory Group.

Mutual funds are sold by prospectus only. Before investing, investors should carefully consider the investment objectives, risks, charges and expenses of a mutual fund. The fund prospectus provides this and other important information. Please contact your representative or the Company to obtain a prospectus. Please read the prospectus carefully before investing or sending money. Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions. . Rebalancing assets can have tax consequences. If you sell assets in a taxable account you may have to pay tax on any gain resulting from the sale. Please consult your tax advisor. S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. You cannot directly invest in the index.

Securities are offered through Mid Atlantic Capital Corporation (MACC), a registered Broker Dealer, Member FINRA/SIPC. Financial Advice is offered through Everhart Advisors a Registered Investment Adviser. Everhart Advisors is not a subsidiary or control affiliate of MACC.

ACR#191796 06/16