See below for the May 2016 edition of our E-newsletter, The Advisor

See below for the May 2016 edition of our E-newsletter, The Advisor

Oversimplification in Target Date Funds Endangers Participants’ Retirement Savings

How are custom solutions evolving to mitigate risk? Part II

Last month we featured Part I of Oversimplification in Target Date Funds Endangers Participants’ Retirement Savings – How are custom solutions evolving to mitigate risk? Part I introduced version 1.0 of target date funds, now learn about version 1.0’s evolution to version 2.0, that sets the stage for version 3.0, which we will end with next month.

Version 2.0: Introducing New Choices

As the single-manager and single-glidepath risks of version 1.0 have become more evident in the marketplace, recordkeepers have stepped up, devising solutions to help plan sponsors address these issues. This leads to TDF version 2.0, a recordkeeper solution that is customized by the plan sponsor. This approach allows plan sponsors to develop a glidepath best suited for their plan’s demographics, while utilizing the underlying managers already in place. In version 2.0, plan sponsors diversify their participants’ assets across a variety of investment managers, on a glidepath better suited for their participant population rather than an off-the-shelf version designed for the median or average participant. Version 2.0 glidepaths generally are a function of a plan’s demographics, not the entire universe of defined contribution investors, which is one benefit of moving from a version 1.0 to a version 2.0 TDF, because version 2.0 allows fiduciaries to better identify a glidepath for their participants.

Version 2.0 Provides Flexibility to Choose a More Appropriate Glidepath

According to our TDF categorization/analysis, 50 percent of version 1.0 TDF providers offer aggressive glidepaths. This means that half of the proprietary version 1.0 providers have allocations that favor equities and risk-based assets not only during the accumulation phase but also near, at and sometimes even through retirement. With approximately 50 percent of version 1.0 TDF providers offering this aggressive solution, the challenge for plan sponsors is selecting something other than an aggressive option if what their participant population really needs is a more moderate or conservative solution. Early on, the recordkeeper constraints on TDF providers exacerbated this problem, only to be loosened somewhat over the years.

The aggressive TDF solution is still the most utilized glidepath today. This is supported by the wide body of evidence suggesting participants do not save enough for retirement. An aggressive glidepath may act as the most appropriate “catchall” for the average participant because most will need more return from their investments to make up for the general lack of retirement savings. It is no coincidence that the top three proprietary version 1.0 providers, Vanguard, T. Rowe Price and Fidelity, all run aggressive glidepaths.

For plans, however, where participant savings rates are high and/or employer contributions are generous, the landscape becomes challenging when identifying an appropriate moderate or conservative glidepath. The more conservative the plan sponsor becomes or the demographics suggest, the options dwindle and very few solutions exist. Version 2.0 allows a plan sponsor to address this, accommodating a less risky glidepath that may be more appropriate for their participants.

Manager Options in Version 2.0

At the same time the glidepath is addressed, version 2.0 allows the plan sponsor to address the managers utilized within the TDF strategy. So, while in version 2.0 a plan sponsor is not tied to an aggressive glidepath, a plan sponsor is also not tied to a single investment manager. For example, there may be an index fund that better replicates a desired index than the index fund currently being used. A plan sponsor can allocate among other types of funds or investment managers, including some strong active managers. It is not an either/or proposition.

Version 2.0 Creates Three New Problems—No Historical Performance, No Fact Sheets, and No Portability Across Recordkeepers

While version 2.0 solves some problems of version 1.0, it unfortunately also introduces three new problems. First, model portfolios do not carry historical performance, so participants cannot reference how the glidepath, or asset allocation, performed over time. Second, typically there are no fact sheets related to the models, meaning there is a lack of education and information for participants. Third, models are recordkeeper-dependent. If the plan sponsor has a recordkeeper that cannot support the model, it requires moving to an entirely new recordkeeping platform. As the plan grows, other options can be affected if the plan were to leave for another recordkeeper for fiduciary reasons. New models would again have to be built on the new platform, subject to the rules and constraints of that new platform. Therefore, the models may not look or act exactly like they did on the old recordkeeping platform.

Over the past ten years, version 2.0 has been available to plan sponsors, but despite its benefits, these three primary problems have limited the adoption of version 2.0 by plan sponsors.

How to Encourage Positive Retirement Outcomes in Tax Exempt Plans

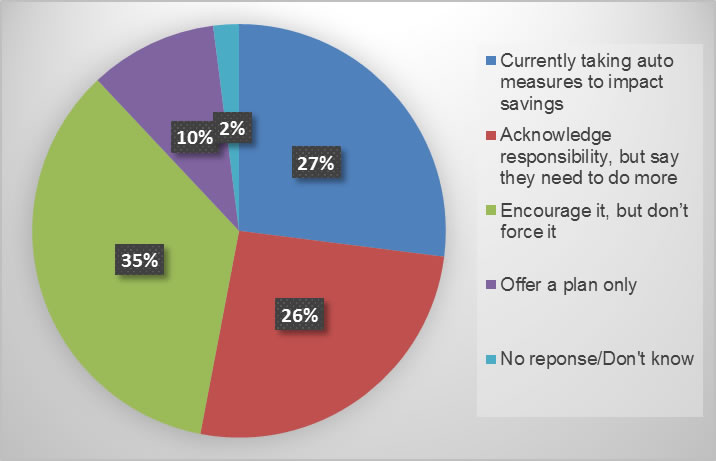

One of the major trends right now in retirement plans is the use of automatic plan design features to encourage plan participation and retirement participation. We have seen a steady increase in adoption of automatic plan design features, at large, in the past few years; however, tax exempt organizations seem to have a different attitude towards the implementation of these strategies. Compared to the general retirement plan population, tax exempt organizations seem to be a bit more split when it comes to measures that would force their employees into retirement contributions. A look at the chart below tells us that, in summation, only 27 percent of tax exempt plan sponsors currently include some type of automatic plan design feature.¹ Plan sponsors of tax exempt organizations generally view retirement plans as another component of their employee benefits offering; putting the decision-making control in the hands of their employees. In addition, tax exempt organizations tend to be more wary of fiduciary liability; so they prefer to be more hands off.

Tax exempt plan sponsors attitude towards automatic features to encourage retirement plan contributions¹

Retirement Outcome Checklist

Entice participants to stay Research shows us that the implementation of a company match can actually triple the odds of plan participation.² Because of budget constraints and the rise in healthcare costs, plan sponsors may be hesitant to implement a matching contribution to encourage plan participation.

Make investment selection easy Make investment decisions easy on participants. Investment decisions can be overwhelming as most participants have little to no investment experience. Be careful not to over inundate them with a large menu of investment options. Instead, offer a limited menu of individual investment options that cover the main asset classes. In addition, offer an off-the-shelf target-date fund to provide participants with a pre-allocated mix of investments based on their anticipated retirement year. Lastly, take it a step further and offer a managed account option in the plan. This provides the greatest degree of direction for participants and allows an experienced third party investment manager to create and manage a pool of investments that most closely aligns with the participant’s risk tolerance, expected year of retirement and personal preferences.

Implement financial wellness programming Twenty-three percent of retirement plans say they offer a financial wellness program.¹ Employees in some tax exempt markets are paid less than their for-profit peers, making them susceptible to financial struggles – including student loans and various debt. Offering a financial wellness program can help provide a structured plan to help participants rid themselves of debt. This could lead to higher plan participation and contributions. After all, people who are not in a good financial situation view retirement planning close to last on their list of financial obligations.

Document the plan strategy Implement an investment policy statement and investment committee charter. This helps to put all of these plan tactics in action and holds the organization and plan fiduciaries responsible for making sure the plan is in good order.

While most of these tactics are beneficial to all organizations, tax exempt organizations are unique in that they are still lagging behind traditional 401(k) plans in the implementation of strategies to encourage retirement preparation.

For more information on tax exempt plan strategies, please contact Everhart Advisors at info@everhartadvisors.com or 800.337.3353.

¹Not-for-Profits Recognize Responsibility in Encouraging Positive Savings Behaviors, PSCA, 12/17/14

²The Plan Participation Puzzle: Comparison of Not-for-Profit Employees and For-Profit Employees, LIMRA, December 2010.4

This is a condensed article written by OneAmerica.

Fiduciary Seminar Alert

Plan fiduciaries have a primary responsibility to understand and prudently discharge their duties in accordance with ERISA and their plan document. To complement the fiduciary consulting services we make available to you, consider taking advantage of fiduciary education sessions hosted by the DOL. The website provided below has great content on other fiduciary topics as well.

In addition to the fiduciary education sessions hosted by the DOL, we invite you to join us for our annual workshops we hold in the Columbus and Dayton areas featuring a speaker from the DOL discussing timely topics. Please look for our invitation this fall and in the meantime, let us know if we can assist you in any areas impacting successful outcomes for your plan.

Please see the following link for more information: https://www.dol.gov/ebsa/fiduciaryeducation.html

When “Float” is a Bad Thing

What is “float”? Float refers to the earnings or “compensation” accruing to a service provider while a plan’s contribution remittance (or other assets held in suspense) is awaiting deposit or distribution.

With many service providers, a contribution received after 2 p.m. EST will not be deposited until the next day. Any return on these remittances that are held overnight (i.e. if placed in an interest bearing account) is considered by the DOL to be “compensation” and therefore treated as such and should be disclosed as required by ERISA Section 408(b)( 2). The plan sponsor, as per 408(b)(2), has a responsibility to determine whether total compensation inclusive of float is reasonable. Failure to do so may result in a prohibited transaction.

This may be a good time to inquire to your service provider as to this issue of float in order for this not to become a compliance issue down the road. The question to pose is as simple as “are there any opportunities for you, the service provider, to obtain what ERISA considers compensation for plan assets held in abeyance either for contributions pending allocation, which may be held in an interest bearing account, a forfeiture account, or a distribution check issued but not yet cashed?”

This ounce of prevention may be worth pounds of cure.

[separator top=”40″]

Communication Corner: Retirement Plan Basics

This month’s memo reminds employees of the importance of participating in the company’s retirement plan with the top ten things to know about their company’s retirement plan.

Email Marketing Software

powered by Cvent

The “Retirement Times” is published monthly by Retirement Plan Advisory Group’s marketing team. This material is intended for informational purposes only and should not be construed as legal advice and is not intended to replace the advice of a qualified attorney, tax adviser, investment professional or insurance agent. (c) 2016. Retirement Plan Advisory Group.

Mutual funds are sold by prospectus only. Before investing, investors should carefully consider the investment objectives, risks, charges and expenses of a mutual fund. The fund prospectus provides this and other important information. Please contact your representative or the Company to obtain a prospectus. Please read the prospectus carefully before investing or sending money. Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions. . Rebalancing assets can have tax consequences. If you sell assets in a taxable account you may have to pay tax on any gain resulting from the sale. Please consult your tax advisor. S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. You cannot directly invest in the index.

Securities are offered through Mid Atlantic Capital Corporation (MACC), a registered Broker Dealer, Member FINRA/SIPC. Financial Advice is offered through Everhart Advisors a Registered Investment Adviser. Everhart Advisors is not a subsidiary or control affiliate of MACC. ACR#186586 05/16