See below for the February 2016 edition of our E-newsletter, The Advisor

See below for the February 2016 edition of our E-newsletter, The Advisor

A Turbulent Start to 2016

The beginning of the year has been a volatile one for the markets, sparking fear amongst investors and serving as a harbinger of possible things to come (for the rest of the year). In fact, the volatility we have seen in January is not only normal, but long overdue. The third quarter pull back of 2015 was a return to a more normal market volatility, which we’ve witnessed since the 1920s, something that has generally been missing since the financial crisis over seven years ago.

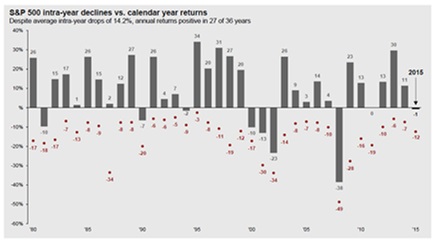

As our third quarter Market Volatility chart (see below) showed, declines of at least 10 percent happen frequently, averaging once every 11 months. Year to date, while the S&P 500 has not yet eclipsed this, it has gotten close. From its last peak, however, it has declined beyond 10 percent.¹ Perhaps somewhat more worrying is that a market decline of at least 20 percent, which has occurred once every four years may be just around the corner. Because 20 percent represents a bear market (a market where the stock market declines over a period of time) investors’ concern has increased as the 2016 slide extends and grows longer.² The long recovery in the U.S., coupled with slowing economies, notably China, and divergent global monetary policies only add to the uncertainty. These alone have been the primary drivers of recent volatility.

This table provides some historical perspective into the size and frequency of U.S. stock market declines from 1928 to 2013.

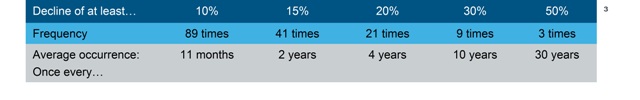

The fourth quarter Drops and Finishes chart (see below) shows that as intra-year declines happen, even ones at the beginning of the year, markets more often than not finish the year positive. Even when they don’t, it is important to acknowledge that market volatility is a component of the stock market and that the stock market is a creator of wealth over not years, but decades. When markets go “on sale”, like today, it often serves as a good time to rebalance into equities. Diversification should help smooth the ride, but if fear does return to the markets, and the market drop continues, long-term investors would do best by making fear their friend. It is always the market recovery after the downturn that proves why.

¹Wall Street Journal

²RPAG

³Motleyfool.com. Obtained by analyzing daily data for the Dow Jones Industrial Average and S&P 500.

⁴J.P. Morgan Asset Management’s 1st Quarter 2016 Guide to the Markets. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposed only. Returns shown are calendar year returns from 1980 to 2015.

Importance of Prudent Process to Monitor Investment Options

A review of the holding in a recent Third Circuit Court of Appeals case provides a reminder of the importance of implementing and following a documented, prudent process to monitor plan investment options. In Santomeno v. John Hancock Life Insurance Co. (Case No. 13-3467 (3d Cir. Sept. 26, 2014)), the plaintiffs (plan participants, not plan fiduciaries) brought an ERISA class action suit against Hancock arguing that Hancock was a fiduciary to the plan and charged excessive fees. The Third Circuit ruled that Hancock was not a fiduciary and dismissed the case. (Earlier in its procedural history, a different Third Circuit case held that participants may bring suit directly against the service provider without having to first bring suit against the plan trustees. The Supreme Court denied review of the earlier decision giving participants standing to sue service providers directly, so that holding stands.)

Under the contested arrangement, Hancock provided 401(k) plans with access to a large line-up of different investment options. The plan’s trustees then selected a smaller menu of investment options from the larger line-up to determine the investment options offered under the plan. The plaintiffs argued that because Hancock had the discretion to select the original larger line-up of offered funds and to make changes to that line-up, it was a fiduciary. The court rejected that argument because the plan fiduciaries had the final decision making authority about what investment options were actually offered under the plan.

The takeaway from this case is that plaintiff’s lawyers continue to find new, creative ways to bring excessive fee litigation against plan sponsors, fiduciaries, and service providers. Plan fiduciaries who make final decisions about what investment options are offered under a plan must comply with their responsibilities under ERISA when making those decisions. As the Third Circuit Court held, a service provider who does not have that final decision making authority is not subject to those same responsibilities. Plan fiduciaries who have a prudent process in place to actively monitor plan investments options, regularly benchmark fees and document that process have a stronger position to defend should litigation ever come knocking on their door.

Investment Policy Statement Review: Beyond the Obvious

The Employee Retirement Income Security Act of 1974 (ERISA) holds fiduciaries to a standard of prudence when making investment-related decisions for a qualified ERISA plan. The Department of Labor (DOL) and the courts have largely determined that said standard of prudence can best be determined by a fiduciary’s process, or procedures, used in making such decisions. And though a written investment policy statement (IPS) is not explicitly required by ERISA, it is considered a best practice to create, and update, one to assist in guiding fiduciaries in making plan-related investment decisions. The DOL routinely requests a copy of a plan’s IPS during investigation. And the courts have regularly looked to the terms of a plan’s IPS to determine if fiduciaries undertook a prudent process in making decisions on behalf of the plan.

The language of an IPS can be a delicate matter. It must be neither too vague nor overly strict. A vague IPS creates no evidence of process. If a court of law cannot determine the actual steps being taken in determining fiduciary action, the IPS is virtually toothless.

EXAMPLE: A client decided to remove the timing conventions for placing an investment on watchlist and potentially removing a fund from our sample IPS. During investigation the DOL requested and reviewed the client’s IPS. The investigator cited the plan for lack of discernible procedure in their IPS. In the investigator’s mind the plan essentially did not have a prudent process because there was no guidance regarding when a fiduciary was to take an action in regards to an investment offered by the plan.

At the other end of the spectrum an overly strict IPS serves to limit the flexibility of the plan fiduciaries and may lead to unintended consequences. A strict IPS typically contains a word such as “must.” This word leaves little room for decision making on the part of fiduciaries. And if the plan ever, even for a moment, doesn’t meet one of the “must” requirements it is out of compliance with the terms of the IPS, a potential fiduciary breach. An overly strict, or overly detailed, IPS may inadvertently set unavoidable traps for fiduciaries.

EXAMPLE: The Tussey v. ABB case provides multiple examples of an overly strict/detailed IPS. The plan had adopted an IPS whose requirements were too easily violated. As a result, though the fiduciaries may have been practicing prudent processes, those processes were not reflected in the terms of their IPS. The court strictly construed the terms of the IPS and found that in multiple occasions the fiduciaries violated their duties by failing to follow the letter of their IPS.

As a result we have routinely reviewed and edited our sample IPS to be reflective of a robust prudent process for making investment-related decisions for ERISA plans. The goal being that the IPS reflects a process that will lead to prudent investment choices for participants while simultaneously mitigating as much risk to fiduciaries as possible under the law. Ultimately each client’s IPS is their own document and should reflect the client’s fiduciary philosophies and goals. Thus the sample IPS may be edited to that purpose, or a client may use a fully custom IPS.

What Constitutes Proper Documentation of Retirement Plan Committee Meetings?

With most retirement plans the fiduciary responsibility of selecting and monitoring the plan’s menu of investments is designated to a retirement plan investment committee. This committee usually includes financial officers and human resources officers of the employer. The committee meets periodically (anywhere from annually to quarterly) to consider agenda items including investment due diligence, fees and services of plan providers, status of plan goals, etc.

From a fiduciary perspective it is just as important to properly document these meetings as it is to hold the meetings. Proper documentation serves as proof that the committee’s responsibilities are being prudently executed. Often plans question the degree of documentation necessary. Below are a few suggestions of what the retirement plan investment committee meeting minutes should include:

• A listing of all parties present with identification of roles (committee member, guest, advisor, provider representative, attorney, accountant, etc.);

• A description of all issues considered at the meeting: fund performance of investments offered, participant communication/education initiatives, plan demographic and provisional review, investment policy statement review, market summary and other topics as appropriate to achieving and maintaining a successful plan;

• Documentation of all materials reviewed during the meeting;

• Documentation of all decisions made and the analysis and logic supporting each decision; and

• Identification of any topics to be continued in subsequent meetings.

For those topics which are relevant to services provided by Everhart Advisors, complete documentation will be included in the Executive Summary which your consultant provides after each meeting. For more information, contact Everhart Advisors via phone at 614-717-9705 or via e-mail at info@everhartadvisors.com.

[separator top=”40″]

Communication Corner: A Turbulent Start to 2016

This month’s employee memo discusses the market volatility we’ve seen so far in 2016 and tips to follow during turbulent times.

Memo: A Turbulent Start to 2016

Email Marketing Software

powered by Cvent

The “Retirement Times” is published monthly by Retirement Plan Advisory Group’s marketing team. This material is intended for informational purposes only and should not be construed as legal advice and is not intended to replace the advice of a qualified attorney, tax adviser, investment professional or insurance agent. (c) 2016. Retirement Plan Advisory Group.

Mutual funds are sold by prospectus only. Before investing, investors should carefully consider the investment objectives, risks, charges and expenses of a mutual fund. The fund prospectus provides this and other important information. Please contact your representative or the Company to obtain a prospectus. Please read the prospectus carefully before investing or sending money. Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions. . Rebalancing assets can have tax consequences. If you sell assets in a taxable account you may have to pay tax on any gain resulting from the sale. Please consult your tax advisor. S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. You cannot directly invest in the index.

Securities are offered through Mid Atlantic Capital Corporation (MACC), a registered Broker Dealer, Member FINRA/SIPC. Financial Advice is offered through Everhart Advisors a Registered Investment Adviser. Everhart Advisors is not a subsidiary or control affiliate of MACC.

ACR#172463 02/16