Consider making a catch-up contribution to your retirement!

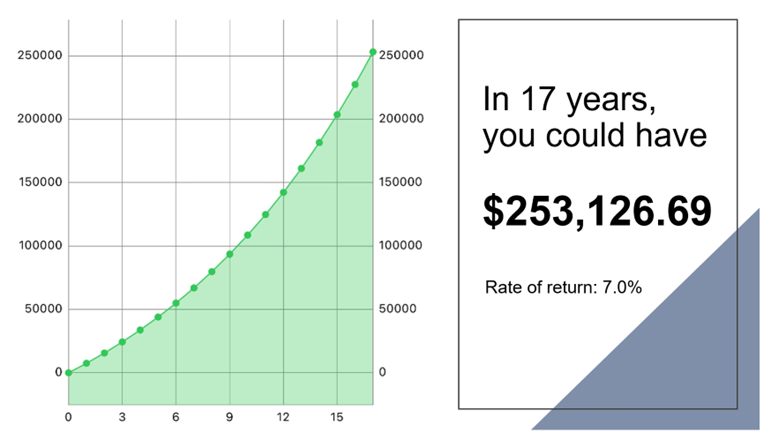

If you contribute $7,500 each year from age 50 to age 67 (17 years), you can make a big impact on your future.

When am I eligible to make a catch-up contribution?

If you turn age 50 anytime in the calendar year, you are eligible to contribute an additional $7,500

into your plan as a catch-up contribution. This is in addition to the $22,500 annual limit.

What does this all mean?

If you wish to save an additional $7,500 per year, you can accumulate over $250,000 in the next 17 years! As the limits to save increase, you may be able to save even more each year.