See below for the December 2015 edition of our E-newsletter, The Advisor

See below for the December 2015 edition of our E-newsletter, The Advisor

Happy Holidays from Everhart Advisors!

On behalf of Senior Leadership at Everhart Advisors, it is my pleasure to extend you the greetings of this special season. It is certainly one of my favorite times of year, and the perfect opportunity to express our gratitude to you for selecting Everhart Advisors as your committed consultant. It is our sincere pleasure to serve you and your plan’s participants. As I look forward to a new year and the hope it brings, I look back as well on our achievements in 2015, and the degree to which we accomplished our primary goals—protecting you as a fiduciary and helping your plan participants prepare for a meaningful retirement. Congratulations for all that you accomplished in 2015. We remain fiercely proud of being your dedicated retirement plan consultant.

As we do each December, this month’s Retirement Times highlights excerpts from issues published in 2015. Please contact us with any questions or feedback; we look forward to serving you in 2016!

Regards,

Scott Everhart, President

Qualified Plan Governance: Is Your Fiduciary House in Order?

Published January 2015

As we enter the New Year, many qualified retirement plan sponsors use this time as an opportunity to examine current fiduciary structure and processes to ensure all is in order.

Whether or not your organization’s retirement plans have been recently audited by the Department of Labor and/or Internal Revenue Service, it is advisable to be sure your plans will hold up under such audit and/or plan participant scrutiny, and that the proper protections for the Company and its designated fiduciaries are in place.

When reviewing your current fiduciary structure, policies and procedures, we suggest the following considerations:

1. If none exists, establish a formal internal Committee to include appropriate representative leadership members.

2. Conduct fiduciary training to educate Committee members on their responsibilities under ERISA and attendant, personal fiduciary liability.

3. Examine, assess and modify current processes – and be in a position to address and answer the following questions:

• Does a written Committee Charter exist? If so, does it need to be updated to reflect the current structure, governance, membership, etc.?

• Has each Committee member signed a written acceptance of his/her responsibilities?

• Are regular Committee meetings held to review plan investments and administration?

• How are decisions made and documented?

• Are minutes kept to document and memorialize committee meetings, attendance, votes, actions, etc.?

• Have previous authorized actions been executed (e.g., investment changes)?

• Does the plan have a written investment policy? It is not required by ERISA, but having and following one is considered the best practice.

• Is fiduciary liability insurance, and/or a company indemnification provision, in place to protect the individual fiduciaries in the event of individual or class action civil litigation?

4. Confirm all required, and related, plan documentation exists and can be easily accessed

• Plan document and amendments (fully-executed)

• Summary Plan Description (SPD)/Summary of Material Modifications (SMM)

• ERISA §404(c) disclosures and general compliance

• ERISA §404a-5 participant fee disclosures

• Favorable IRS Determination Letter

• Service provider agreements/ERISA §408(b)(2) fee disclosures

• Service provider selection/monitoring process and outcomes

• Parties-in-Interest

• Compliance testing results, and corrective action, if applicable

• Government audit results, and corrective action, if applicable

• Self-audit results, and corrective action, if applicable

Our belief is that with this review made and necessary corrective steps taken, plan fiduciaries will take comfort in knowing their collective fiduciary house is in order and will pass muster under government review, and plan participants will be assured that the Committee’s decisions and commensurate actions are being made with their interests in mind.

If you have questions about, or need assistance with, achieving this result, please contact Everhart Advisors via phone at 800-337-3353 or email at info@everhartadvisors.com.

Safe Harbor Regulations Rethought

Published March 2015

Traditionally safe harbor contributions have been rather stringent. Once adopted, there seemed to be little leeway allowing suspension or discontinuance. In 2014, the IRS issued new, final regulations of the requirements that need to be met to reduce or suspend a safe harbor contribution during a plan year. The new regulations are effective for plan years beginning on or after January 1, 2015. If the plan year is the calendar year, the new regulations apply now.

Under the new regulations, a safe harbor match or safe harbor nonelective contribution may be suspended or reduced midyear in two instances:

1. The plan sponsor is “operating at an economic loss” as defined in Code Section 412(c)(2)(A), (one determinant of whether the business is experiencing a hardship).

2. The annual safe harbor notice provided prior to the beginning of the plan year included a statement that the safe harbor contribution may be reduced or suspended during the plan year.

In addition to one of these two requirements being met, certain procedural requirements must be met as well. The procedural requirements are as follows:

1. Amend the plan prior to year end to reduce or suspend the safe harbor. The amendment should not be effective until the earlier of its adoption date or 30 days after participants are provided the supplemental notice.

2. Provide participants with a supplemental notice explaining the consequences of the reduction/suspension.

3. Give participants a reasonable opportunity to change their deferral elections as a result of the reduction/suspension.

4. Make all safe harbor contributions through the effective date of the amendment.

5. The plan amendment must provide that the plan will satisfy ADP & ACP testing for the entire plan year using the current year testing method.

6. The plan must satisfy the top-heavy requirements.

While certain allowances have been made, the idea behind safe harbor remains the same which is to enhance the participant benefit. Although there is some new flexibility, the decision to suspend or discontinue safe harbor plan design should be thoughtfully considered.

If you have any questions about these new safe harbor regulations, please contact Everhart Advisors via phone at 800-337-3353 or email at info@everhartadvisors.com.

Active Managers Can Add Value

Published May 2015

There has been much publicity about active managers’ inability to beat their benchmarks over the years. However, upon closer inspection, funds that have remained truly active have shown ability to add value above their benchmarks. A study conducted by Yale professors Martijn Cremers and Antti Petajisto set out to find variables that could help predict fund performance. One variable was active share, which measures a fund’s percentage of holdings that differs from the benchmark index. For example, an index fund has an active share of zero percent and an active fund with no benchmark overlap has an active share of 100 percent. They found that active share is predictive of excess returns. Their study showed that funds with the highest active share outperform their benchmarks by 1.51–2.40 percent a year before expenses and 1.13–1.15 after fees and expenses.¹

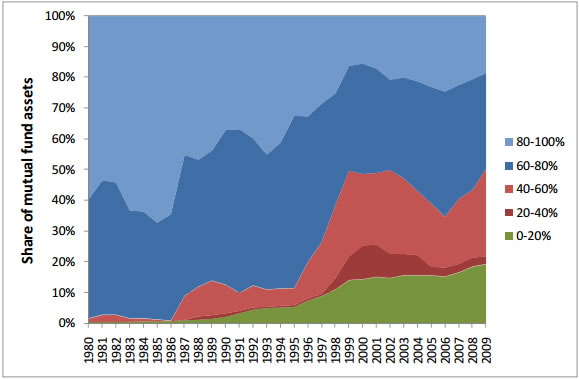

The mutual fund industry has evolved over the last 35 years, from an environment where most fund managers had portfolios significantly different than their benchmarks, compared to today where many have high benchmark overlap. In 1980 only 1.5% of fund assets had active share below 60% compared to 40% of fund assets at the end of 2009. Additionally, share of mutual fund assets in very active funds (80-100% active share) decreased from 60% to less than 20% over that same time period. Closet indexers (20-60% active share) now make up about a third of mutual fund assets.² It is no coincidence that the cumulative excess returns of the median active fund peaked in the early 1980s and have steadily eroded with the proliferation of closet indexing.

The merit of active share is intuitive. If a fund is too similar to the benchmark it is trying to beat, the fund can’t generate enough excess returns to overcome fees charged to the investor. Furthermore, the key to outperforming over time is to consistently apply a well-defined process. If a manager has a well-defined process which seeks specific characteristics in a security, by definition it should produce a portfolio that is significantly different than the benchmark most of the time.

However, all active share is not created equal. Tracking error, which measures the variability of returns compared to the benchmark, is another important piece of the puzzle. Funds with very high tracking error tend to have large factor or sector bets that result in high volatility of returns compared to the benchmark. Cremers and Petajisto found that high active share managers that focused on stock selection within a diversified portfolio, while mitigating tracking error, had the best results. This group is represented by funds in the highest quintile of active share while excluding the highest quintile of tracking error. Funds with high active share and high tracking error and substantial factor bets were the worst performing sub group.³ In other words, managers who focus on stock selection as an alpha driver produced better results compared to managers that take large sector or factor bets.

Active share is just one factor to consider when selecting fund managers. Obviously, if a manager lacks skill and a sound investment process, high active share will only increase the risk fiduciaries are trying to minimize. Our Scorecard is in place to reduce this risk and help fiduciaries identify the skillful managers. Used in conjunction with high active share and moderate tracking error, the evidence suggests that active managers can add value.

¹ https://papers.ssrn.com/sol3/papers.cfm?abstract_id=891719

² https://www.cfapubs.org/doi/abs/10.2469/faj.v69.n4.7

³ https://www.petajisto.net/research.html

[separator top=”40″]

Communication Corner: Increase Retirement Plan Contributions

This month’s employee memo discusses increasing retirement plan contributions simultaneously with pay increases to minimize financial impact.

Memo: Increase Retirement Plan Contributions

Email Marketing Software

powered by Cvent