With the recent uptick in inflation data our team thought it useful to give lifetime investors some perspective. Investors have mixed responses for what increasing inflation means for their portfolios, but the consensus is generally negative. Many people might not understand why high inflation is bad, but there are many reasons, the most obvious of which is items get more expensive thereby limiting the amount of goods and services you can buy. To put it another way, $10 will buy fewer goods and services in the future than it does today. This is called a “loss of purchasing power.” So how do we avoid losing purchasing power? How do we keep pace or even outpace inflation? History has shown us that investing in companies (i.e. stocks) over long periods of time is a great way to accomplish this goal.

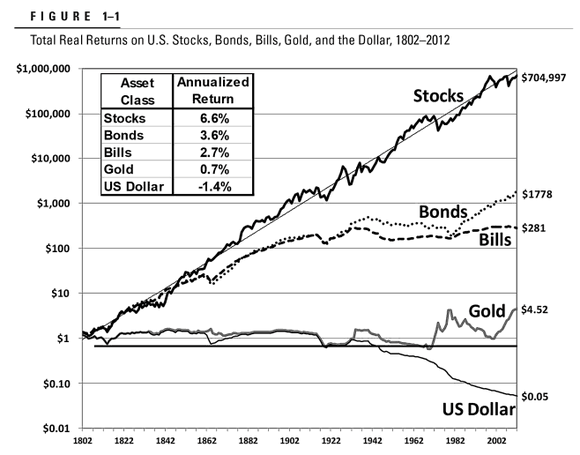

Jeremy Siegel, a professor of finance at The Wharton School, published a masterful work on investments called Stocks for the Long Run. Anyone who reads it will understand why he decided on such a straightforward title. In chapter 1 he declares the following chart the most important in the entire book and we tend to agree.

The graph shows annualized returns net of inflation (i.e. real returns) for over 200 years. As you can see, the asset class that has consistently proven to increase purchasing power is stocks. I would encourage everyone to truly soak in the graph. A person holding cash saw their purchasing power erode over time. A person holding a commodity like gold was able to maintain pace with inflation and those holding treasury bills or bonds slightly beat inflation. None of those assets, however, helped people build wealth and increase purchasing power the way stocks did.

Another data point to consider in Siegel’s masterpiece is found in chapter 14 where he specifically focuses on the impact of inflation. He looked at real returns for stocks, bonds, and treasury bills since 1871. All three asset classes averaged a negative real return over a 1-year holding period when inflation was deemed “very high.” This backs up the negative notion that most investors have toward high inflation. The numbers change, however, when looking at a longer period of time. Bonds and bills averaged below 2%, whereas stocks averaged over 6% for 30-year holding periods with “very high” inflation. Stocks grew at three times the pace of bonds and treasury bills! And even in a “very high” inflation period stocks were near their 200+ year historical average of 6.6%. The data demonstrates that higher inflation had nearly no effect on stocks’ returns over long periods of time, but it did negatively affect bonds and treasury bills.

No one knows for certain if higher inflation will continue, but we do know how markets have reacted over long periods of time. Although past returns do not guarantee future results, we encourage people to consider the long track record of each asset class and plan accordingly. Investing on a plan rather than reacting to news headlines is essential to reaching your lifetime investment goals. Please reach out to our team if you would like to discuss this further or work on a financial plan.

| Max Rosenthal Wealth Manager CFP® |