![]() Election Year Investment Volatility

Election Year Investment Volatility

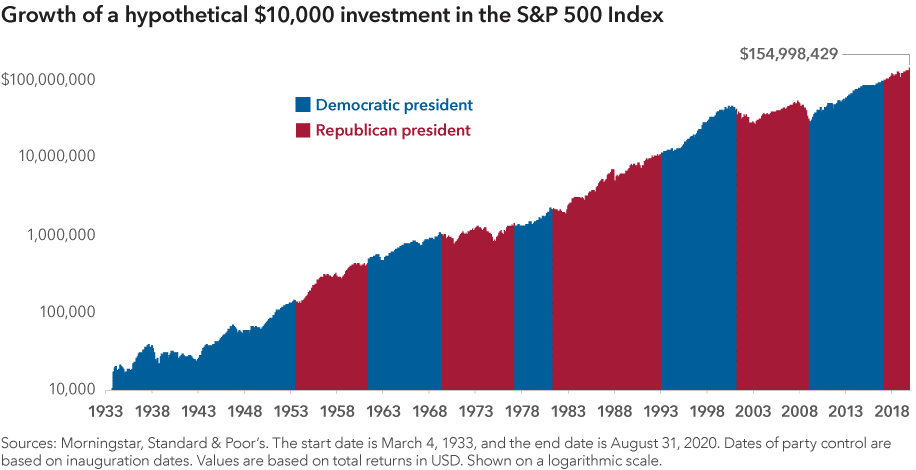

Election years, with their uncertainty and increased emotions, cause anxiety for investors. Certainly, there may be short-term market volatility around elections, but history suggests that over the long-term the economy and markets move higher regardless of election outcomes.

In fact, presidents often receive too much credit for strong economies and markets, as well as too much blame for weak economies and markets. Corporate earnings are the real driver of the market over time. Presidents have less impact on corporate earnings than many perceive.

Most recently, the market fell after the Trump election. However, it quickly reversed to a strong upsurge over the next few years. Investors that sold out of the market on Trump’s election missed out on several strong years of returns. This has played out many times in history. Looking at the long-term effects of presidential transitions, as the chart below shows, markets have trended higher over the long term regardless of whether a Republican or Democratic president held office.

The key to investment success, as always, is diversification and a long-term investment horizon. It is important for investors to tune out the short-term noise and keep a long-term perspective.

Chart Source: Capital Group

Past performance is not a guarantee of future results. The S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. You cannot directly invest in the index.

Retirement Income Survey

Attaining a satisfactory retirement experience is dependent on sufficiency of post retirement income. In an attempt to identify current attitudes in this regard the *Alliance for Retirement Income surveyed

pre-retirees between the ages of 56 and 75 (with a minimum of $100k assets) regarding their anticipated timing of their retirement. https://www.allianceforlifetimeincome.org/feature/americans-more-pessimistic-about-retirement-plans-due-to-pandemic/

Here are some highlights resulting from the survey:

- 20% decided to retire later than originally planned

- 52% are not fully confident they will be able to retire when they want to

- 47% of retirees say their retirement was partly based on factors out of their control

- 76% overall have some lifetime income from an annuity (35%) or a pension (65%), or both

- Only 33%, felt “very confident” having sufficient income to meet all expenses in retirement.

This survey was taken during the Covid-19 pandemic, which may have dampened some financial expectations, but it also only covered those with over $100k in assets. Perhaps those with fewer assets may be more pessimistic.

Although the non-profit education-oriented Alliance sponsoring this survey is proponent of, and therefore may have a bias toward protected retirement income programs, the validity of their conclusions is strong.

In this age of extended life expectancies, the potential of “phased retirement” workplace options and delayed retirement may help in managing better financial outcomes during retirement.

*The Alliance for Lifetime Income is a non-profit 501(c)(6) educational organization based in Washington, D.C., that creates awareness and educates Americans about the value and importance of having protected lifetime income in retirement.

![]() Annual Plan Audit: An Auditor’s Perspective

Annual Plan Audit: An Auditor’s Perspective

Does your plan require an annual audit? If your eligible participant count (including terminated employees who maintain an account balance) exceeds 100 at the beginning of your plan will you be required to conduct a benefit plan audit including financial statements attached to the Form 5500 (the one exception is the *80-120 rule.) The audit is intended to confirm the plan is operating within the guidelines of the plan documents and follows specific Department of Labor and IRS regulations.

This article identifies auditors concerns in areas of plan management that may lead to plan fiduciary exposure to litigation and regulatory breaches. The main differences auditors find are:

- Documentation for all fiduciary level decision-making: ERISA fiduciary decision-making must follow the ERISA definition of procedural prudence, which entails a specific and rigorous process.

- Establishment of Retirement Plan Committee: Every Retirement plan should establish oversight committee which meets regularly to review plan status and conduct plan management functions. This committee should be memorialized with a committee charter identifying fiduciaries and their functions and should be adopted via a board resolution.

- Formal Investment Policy Statement (IPS): An IPS provides a “road map” which must be followed for selection and monitoring all investments within the plan. A non-executed (unsigned) IPS is typically perceived by regulators and courts as not having of an investment process, which may result in an indefensible fiduciary breach of duty.

- Definition of compensation: Definition of compensation is not always a simple matter. Because your plan may use different definitions of compensation for different purposes, it’s important to apply the proper definition for deferrals, allocations, and testing. A plan’s compensation definition must satisfy rules for determining the amount of contributions. If the definition of compensation found in the Plan Document is not administrated precisely for 401(k) purposes a fiduciary breach is likely. This can be a costly oversight.

- Minutes from retirement plan oversight committee meetings: Each Plan Committee meeting, with topics discussed and conclusions, must be documented to affirm procedural prudence.

- Definition of eligible employee: Definition of an employee, much like that of compensation, is sometimes misunderstood or inaccurately administered. An example would be that of part time employees being ineligible for plan participation. The term part time employee itself has no meaning under ERISA which focuses on hours worked when attributing eligibility to employees. This issue is often misunderstood.

- Documentation of service provider selection and monitoring: This issue is very important for many reasons. Those most impactful on plan fiduciaries are determining reasonableness of fees, services, and investment opportunities. The documentation of this process, in accordance with procedural prudence, is essential for fiduciary liability mitigation as it is the cause of much litigation.

- Cybersecurity controls: Plan Sponsors need to be mindful about the sensitive data they manage on behalf of retirement plan participants: their dates of birth, Social Security numbers and account balances. Security breaches could occur through phishing, malware, or a stolen laptop, etc. This is a relatively recent but rapidly expanding area of potential fiduciary liability.

- Education to participants: In addition to providing all pertinent plan level information, it behooves plan sponsors to provide sufficient participant education such that participants are able to consistently make informed investment decisions.

- Delinquent remittances of EE deferrals: Delinquent remittances is a frequent and typically unintentional fiduciary operational breach. It has been stressed by ERISA and in litigation activity that participant deferrals should be remitted to the investment providers as soon as administratively feasible. This has been interpreted to mean as soon as you are able to remit payroll taxes.

- Plan Forfeitures: Plan Forfeiture administration is another often misunderstood or overlooked operational responsibility. Plan forfeitures, employer contribution amounts that accrue when an employee leaves the Plan and their account is not fully vested, should be allocated at the end of each plan year in which they were accrued. If you hold forfeiture allocation longer, this becomes a fiduciary breach and one which can be time consuming and administratively difficult to correct.

Please contact us with any questions you may have.

*The 80-120 rule provides an exception for growing businesses. If you (a) have between 80 and 120 participants, and, (b) were considered a small plan in the previous year, you can continue to file the shortened version of the form. When you report at least 121 participants, you must file as a large plan. If you file as a large plan after employing the 80-120 exception, you must continue to file as a large plan – even if your participant count drops below 120 – as long as you have at least 100 participants in your plan.