As a financial advisor I find myself “talking shop” with greater frequency during an election year. Thinking about how each candidate and their policies will affect the economy and the stock market is commonplace when one is considering how to allocate investments. I hear the following questions quite frequently, so it seemed timely to put together some data to help keep things in perspective through this upcoming election.

“Is the stock market safe right now?”

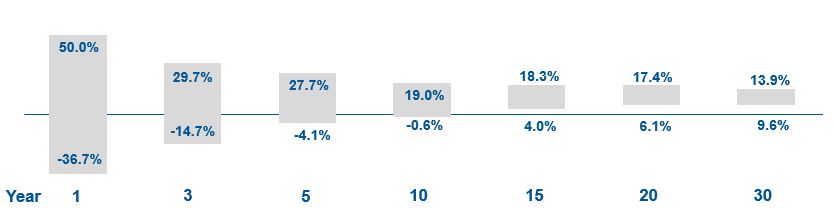

When it comes to investing, “safe” is a word that requires context. If you ask if the stock market is safe for a person investing for 50 years down the road, historic data would suggest it is. If you ask if the stock market is safe for a person who needs their money within the next 2 years, history would suggest otherwise. When asking if it is “safe” to participate in the stock market, you always need to consider the time frame of your investment. Warren Buffet famously said, “rule number 1 with investing is to never lose money.” Keeping this in mind during the upcoming election, the question an investor needs to be asking themselves is, “how long until I need to use this money?”. Historically speaking, anyone investing for less than a decade is wise to have a cautious approach to the stock market. Investors looking a decade or longer should feel more optimistic or “safe” participating in the market. Since WWII there are only two 10-year periods where the S&P 500 Index was negative: 98’ to 08’ and 99’ to 09’. Investors had to bear two recessions in those 10-year time frames. Every other 10-year period since 1945 was positive and every time period 11 years or longer was positive. The 75-year period, which included an election every 4 years, and had presidents representing both parties, averaged 11.4% annually. Below is a chart looking at the range of returns for different time frames for the S&P 500 since WWII. As you can see, the longer your time frame the “safer” it has been historically to participate in the stock market.

Source: Dimensional Matrix Book 2020

“Should I pull my money out of the market and put it back in after things have cooled down?”

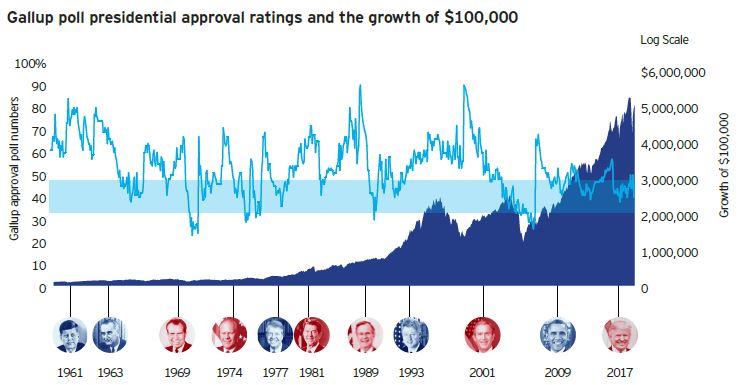

Do things ever really cool down? It is easy to have a heightened level of fear if you listen to the media long enough. One of the strongest human emotions is fear and media outlets understand that producing content touching on that emotion will always generate a stronger following. If one waits for things to cool down, or perhaps waits for the election to be over before they get back into the market, they will have a difficult time finding that moment of peace. Invesco published an informative piece on elections and market history that included a graph showing presidential approval ratings and the market. Regardless of how people felt about the president in office, companies kept creating, innovating, and finding ways to make a profit, and the market continued to climb, albeit with short-term dips along the way.

Source: Invesco

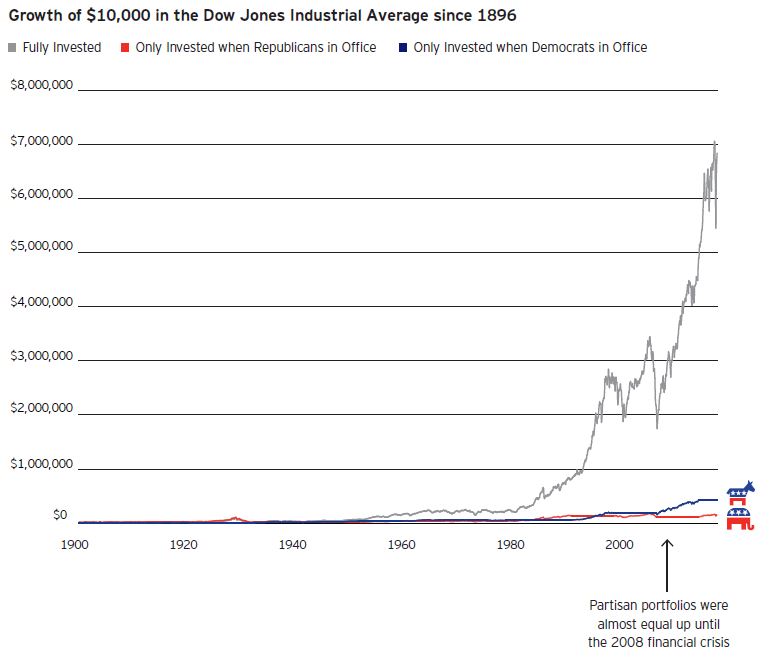

“If candidate X wins will the market go down?”

I recently saw that Mark Cuban, one of our nation’s high-profile businessmen and Dallas Maverick’s team owner, made a bold claim prior to the last election in 2016. “I have no doubt in my mind that if President Trump wins the whole market is going down.” He even claimed to hedge the market with his personal assets if the polls started to indicate a Trump victory. I do not point this out to endorse President Trump, but to note how poor that investment would have been had Mark Cuban shorted the stock market. The S&P 500 closed at 2,139.56 on election day in 2016 and has since grown 64% to 3,511.93 (as of 10/13/2020). If we look at a longer-term perspective, since 1896 investors who participated in the market when their party of preference was in office would have drastically underperformed the market. Invesco points out that $10,000 invested in the Dow Jones grew to over $7,000,000, whereas partisan portfolios were below $1,000,000.

Source: Invesco

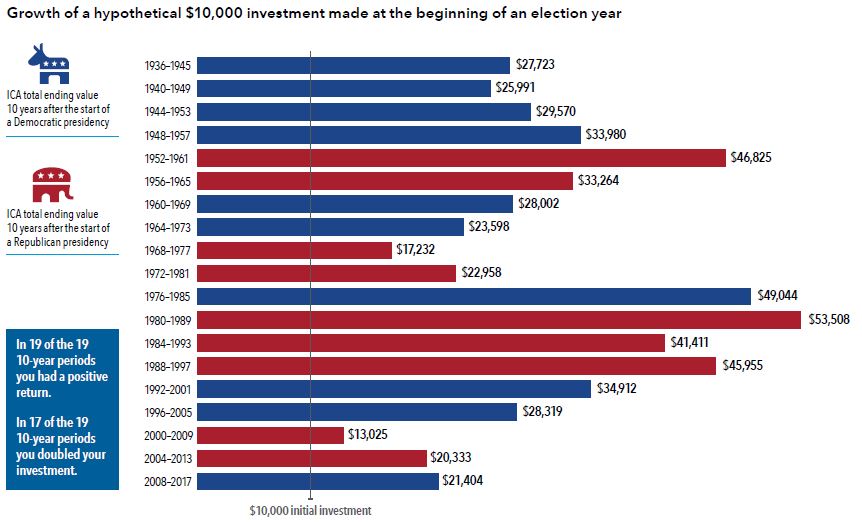

For American investors one thing is certain; there is an election every 4 years. They will need to deal with this heightened level of uncertainty repeatedly over their lifetime. Historic data has shown us that the long-term investor would be wise to remain invested regardless of which party is in office. A change in policy is not what created electricity, the internet, or the smart phone. It always has been and still is based on the ability of companies to innovate, create efficiencies, and utilize natural resources to increase earnings over time. To conclude, I direct your attention to a piece below from Capital Group looking at their Investment Companies of America portfolio, which is invested in companies similar to what you would find in the S&P 500 Index. Since 1936, 19 of the 19 elections had a positive return one decade later and 17 of the 19 doubled!

Source: Capital Group

This article is meant to help the lifetime investor maintain perspective during this election year and is not meant to be direct or personal investment advice. Past performance does not guarantee future returns. Investing in the market always entails risk and one should understand any investment vehicle before investing in it.

| Max Rosenthal Wealth Manager CFP® |