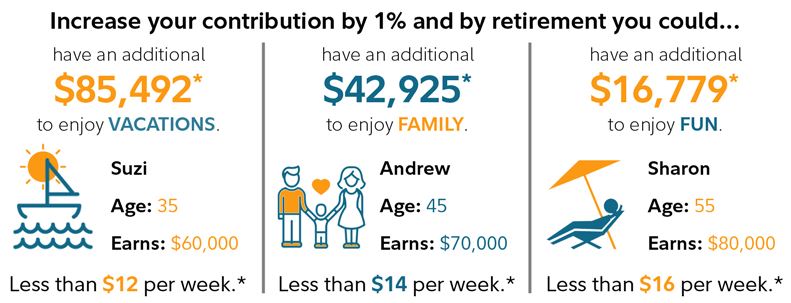

The impact of saving just a few pennies extra for every dollar you earn can result in thousands of dollars over time. Start off the New Year with a win by increasing your 401(k) or 403(b) contribution by 1%—just 1 penny for every dollar earned! Taking this small step each year can make a meaningful difference in your lifestyle in retirement.

While 1% is a small percentage of your annual earnings today, after 20 or 30 years it can make a big difference in your account balance when you retire. That’s because the longer you give your money a chance to grow, the better. And it works no matter how old you are—or how far off retirement is.1

Let’s look at some examples.1

Go for it

Challenge yourself to save a little more. Consider giving yourself an additional gift of contributing another 1% (just 1 penny per dollar) starting on your birthday each year!

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

*Approximation based on a 1% increase in contribution rate. Continued employment from current age to retirement age, 67. We assume you are exactly your current age (in whole number of years) and will retire on your birthday at your retirement age. Number of years of savings equals retirement age minus current age. Nominal investment growth rate is assumed to be 5.5%. Hypothetical nominal salary growth rate is assumed to be 4% (2.5% inflation + 1.5% real salary growth rate). All accumulated retirement savings amounts are shown in future (nominal) dollars. This assumes no loans or withdrawals are taken throughout the current age to retirement age. Your own plan account may earn more or less than this example and income taxes will be due when you withdraw from your account. Investing in this manner does not ensure a profit or guarantee against a loss in declining markets. Investing involves risk, including the risk of loss.

Source: 1https://www.fidelity.com/viewpoints/retirement/save-more