You did it, a perfect balance. A wonderfully crafted portfolio that maximizes long-term return potential while considering the degree of risk you are willing to take. But after market fluctuation and different returns for each investment, your portfolio is out of balance. Now what? Rebalancing is a way to return your portfolio to its original allocation. There can be significant benefits to rebalancing, such as maintaining your risk tolerance or capitalizing on market volatility. However, there are certain things to consider when rebalancing.

Rebalancing is a simple concept, but it is often counterintuitive to many investors. To rebalance, you will sell the winners and buy the losers. Investors struggle with selling what is making them money to buy what is currently down. Portfolios are created with a goal in mind. If the plan changes because market conditions change (which is expected) then it’s not really a plan. When emotions creep into investing, people can make decisions that drastically affect whether they are able to reach their goals. Regular rebalancing should be a part of your portfolio plan and can help take the emotion out of your decision making.

Unchecked Risk

A 60/40 asset allocation, 60% equities and 40% bonds, is a popular portfolio amongst investors. The mix balances the potential for high growth but riskier stocks with the historically less risky but smaller upside of bonds. Market movements will cause the 60/40 mix to drift over time, rebalancing will help keep the portfolio in line with risk tolerance. Take a $100,000 60/40 portfolio for an example; if stocks are up 20% for the year and bonds are down 5%, the investor isn’t bothered, the portfolio is up and now worth $110,000. But the portfolio is now a 65/35 blend. If the following year stocks are down 10% and bonds are up 10% the portfolio would be worth $106,600. But if the portfolio had been rebalanced back to 60/40 after the first year the ending balance after the second year would be $107,800, a $1,200 difference in favor of the rebalance. One argument to bring up would be if stocks increased two years in a row, the non-rebalanced portfolio would have outperformed the rebalanced portfolio. This is true, but no one knows what will happen in that second year. What we do know is that most investor’s risk tolerance does not change because their portfolio is up. Rebalancing aligns the portfolio with the investor’s risk tolerance.

Buy low, sell high

For rebalancing to be effective, a portfolio needs to be broadly diversified. Represented by different sectors, styles, and geographic locations. This is the first hurdle for investors because if you are diversified, part of your portfolio will usually be underperforming. But as Nick Murray says, “We will never own enough of any one idea to make a killing in it. We will never own enough of any one idea to get killed by it.”[1] Because you are focused on the long term, your diversified portfolio will still earn the full returns of all the components, while somewhat mitigating the short-term volatility.

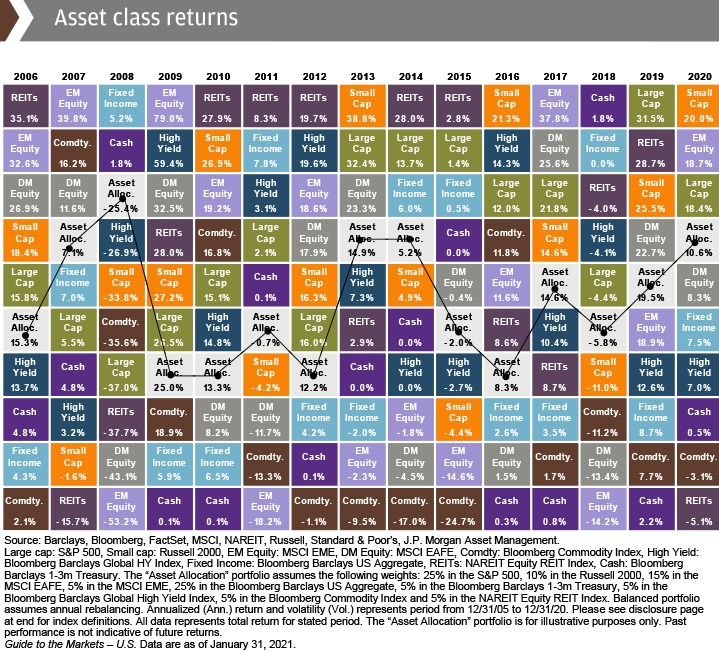

Each sector of the market performs differently. The chart below shows annual sector performance since 2006.

You can see that because a sector performed well one year, does not guarantee that it will continue to perform well. Rebalancing is a way to harvest some gains from investments that are now expensive and reinvest them into areas that are now cheap. This is easier said than done. Not from a technical perspective, but from a behavioral one. Like mentioned before, people do not like to sell when an investment has gone up. But a planned rebalance either by weighting or by schedule is a way to take the behavior out and put discipline in.

How and when

One method of rebalancing is to assign a percentage band to each holding, +/- 5% for example. When the holding moves outside the tolerance band, the entire portfolio is rebalanced or only the securities outside the tolerance bands are traded. This method unfortunately takes monitoring and could be expensive depending on your account’s fee structure. The simpler method would be calendar rebalancing. The portfolio is rebalanced at predetermined intervals to the original allocation. This method is desirable for most investors because it is simple to maintain and takes the emotion out of the process. Many 401(k) recordkeepers allow you to set up automatic rebalances through their site. An all equity portfolio will benefit from rebalancing more frequently whereas a blended stock and bond portfolio should be rebalanced less often. Most portfolios should be rebalanced one to four times a year. Abiding by a schedule does not require tracking tolerance bands and removes the temptation to go all in on whatever is currently making headlines.

Things to consider

If you are rebalancing in a qualified account such as an IRA, Roth IRA or 401(k), rebalancing will have no tax consequences. However, a non-qualified account such as a brokerage account may realize significant gains and could be taxable. Alternative methods to maintain allocation in a taxable account include using dividends and interest to buy lower performing securities, or to use new money to correct allocation drift. Make sure you understand the fee structure in your account. If you pay a trade commission, rebalancing may be expensive.

Rebalancing is not glamourous, but it is a discipline that favors the long-term investor.

[1] Murray, Nick. Nick Murray’s Scripts; 2019