Many thrill seekers pay big money and wait in long lines for some of the world’s most extreme rollercoasters. Most investors, however, do not enjoy any moment when their retirement portfolios drop. Before we jump into the benefits of volatility, I want to point out that this article is aimed at the lifetime investor—a person trying to reach their financial goals by putting a portion of their income paycheck by paycheck into long-term investments like the stock market.

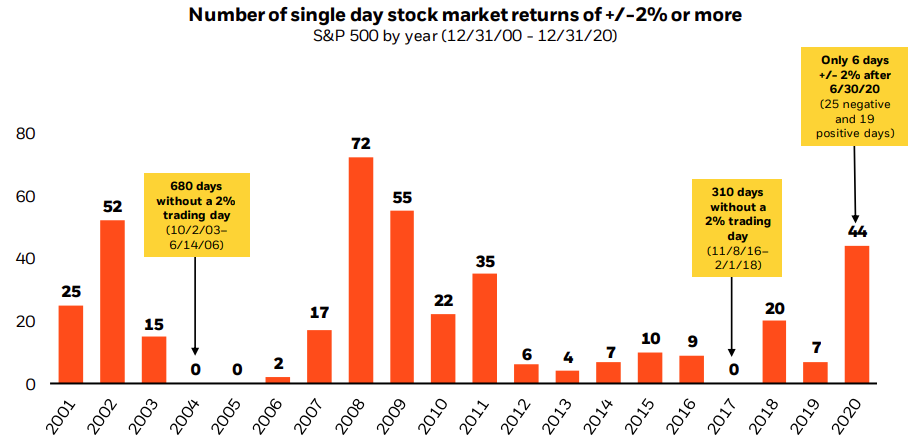

Volatility can be described as the price of the market changing positively or negatively at a greater rate than normal. If the market traditionally moves by +/- 1% per day, then the market moving by +/-2% would be considered volatile. It might not surprise you that the market historically is most volatile when a surprising event happens in the world; like the early part of the 2000’s with the tech-bubble and 9/11 terrorist attack, the 2008-2009 financial crisis, or the world pandemic just this past year (see exhibit 1), but one must note that market volatility happens in some capacity every single year (see exhibit 2).

It is against human instinct to love when the market drops. The point of investing in the first place is to increase the dollars you have, which is why many investors decide to pull their investments out after a market drop. The lifetime investor, however, is long-term focused—so they should LOVE market drops. I will say that again because it is worth repeating. The lifetime investor is long-term focused—so they should LOVE market drops! As you read that statement, you are probably not nodding your head in agreement, but let me explain.

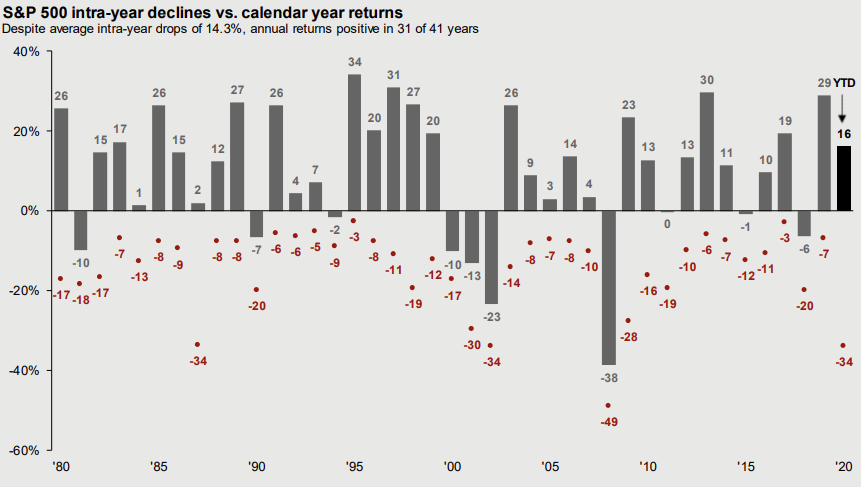

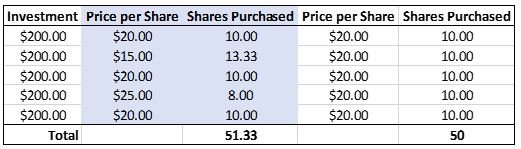

What happens for someone who continues to invest paycheck after paycheck is they end up buying more shares after a market drop and less shares after a market increase. Ultimately, this increases the number of shares someone has which increases the rate of return (see exhibit 3). This is a wonderful concept when one considers the volatility of the stock market. For example, over the last 41 years the S&P 500 index had an average drop of 14.3% each year but had a 9% annual rate of return (see exhibit 2 again). Talk about volatility!The temptation for many people, of course, is to opt out of their investments during these rollercoaster moments, which is one reason many people are not successful investors. The lifetime investor, however,should grow to love these wonderful moments where they are able to buy more shares at lower prices. So next time the world gives us a curveball with something like COVID-19, the financial crisis, or the 9/11 terrorist attacks, consider staying the course with your lifetime investments and enjoy the ride of buying more shares after market drops.

Exhibit 1:

Source: BlackRock®. Morningstar as of 12/31/20. Stock market represented by the S&P 500 Index. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

Exhibit 2:

The dark grey bars represent the full calendar year return whereas the red dots represent the biggest intra-year drop. As you can see, majority of the time the market is up, however every year for the last 41 years has experienced some market drops.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2020, over which time period the average annual return was 9.0%. Guide to the Markets – U.S. Data are as of December 31, 2020.

Exhibit 3:

This hypothetical shows the effect of volatility. The investor invests $200 each time, but the blue area shows the price per share changing by $5 each time, whereas the white area’s price per share stays constant at $20 per share. As you can see, the blue column ends up with more shares.

Volatility does not guarantee future returns.